Australia-South Africa update: SAA returns and Qantas delays A380 introduction

Last year we published a blog examining Qantas’s decision to introduce the A380 on the Sydney-Johannesburg routes. The move surprised many, but our analysis highlight how the A380’s increased capacity was offsetting capacity losses between Australia and South Africa following the withdrawal of the B747-400 from the Qantas fleet and replacement by the smaller B787-9, and the continued absence of South African Airways’s Perth services.

At the time, we remained sceptical that SAA would return to Perth anytime soon, but we’re happy to eat our words. SAA returns to Perth today (29 April 2024) after a four year absence with a 3x weekly service. This reestablishes an important historical link and provides some competition to Qantas. Competition is important since we argued that Qantas’s choice of servicing Johannesburg at lower frequency was enabled by the lack of direct competition.

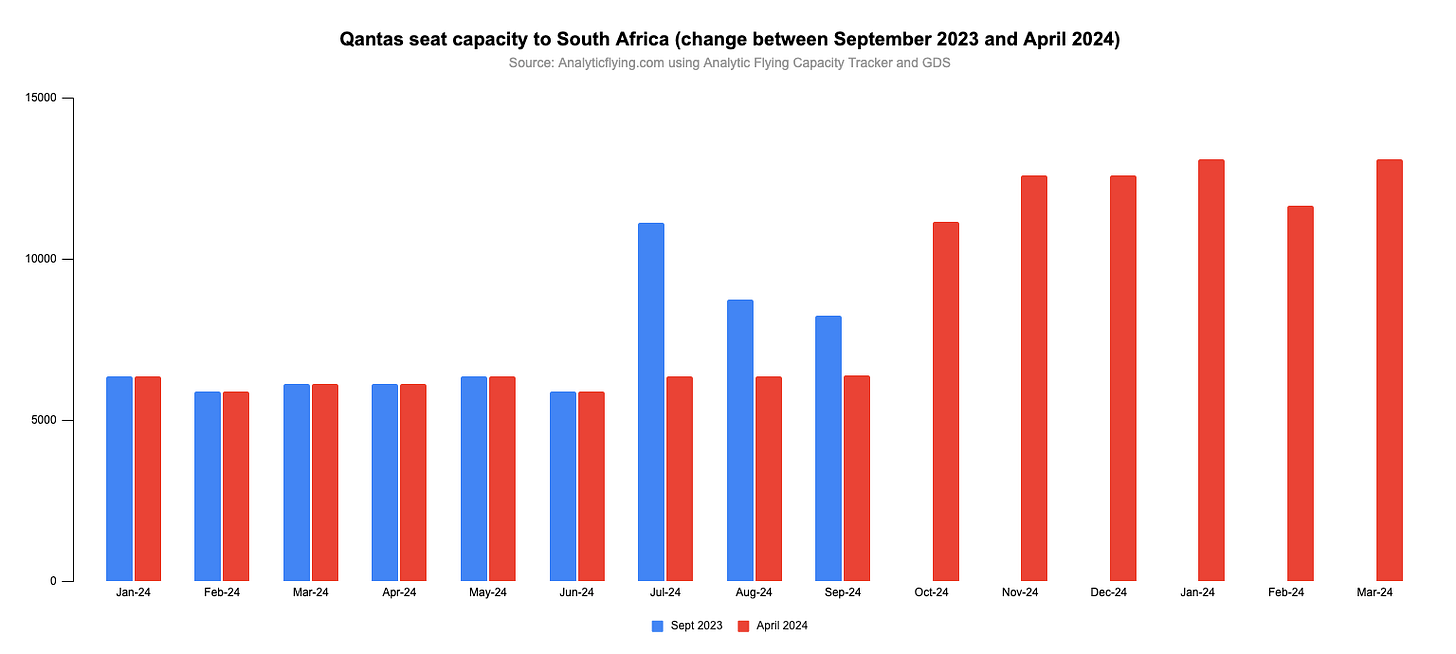

Qantas’s planned operation has also evolved. Qantas originally planned to introduce the A380 to Johannesburg from 7 July 2024, initially 6x weekly before reducing frequency to 4x weekly from the beginning of August, and increasing frequency back to 6x weekly from October in preparation for the summer season. Due to delays in heavy maintenance and cabin refits, Qantas have adjusted the schedule, delaying the introduction of the A380 to 30 September, with a 5x weekly service replacing the 6x weekly B787-9, before increasing to 6x weekly from the end of October.

The delay in the introduction of the A380 has had a meaningful impact on Qantas’s capacity for the three month period, resulting in a loss of 4744, 2358, and 1860 seats in the months of July, August, and September, respectively. However, the loss in Qantas’s capacity is offset by the reintroduction of SAA’s Perth services.

SAA’s return is at a lower frequency than their pre-pandemic operation that generally operated 6x weekly or daily, but also occasionally operated with a larger A340-600. In the 11 months between May 2024 and March 2025 (end of current scheduling period), SAA will provide only 46% of the seats they operated in the comparable pre-pandemic period. However, Qantas will provide 108% of the seats they operated and combined, the two airlines will provide 81% of the pre-pandemic capacity.

Considering only the period from October 2024 (i.e. once the A380 is introduced), Qantas will provide 132% of their pre-pandemic baseline compared to 48% by SAA, while on a combined basis this will amount to 96%.

Future prospects

Despite the delay in the introduction of the A380, capacity between Australia and South Africa is recovering following the COVID-19 pandemic. The surprising but welcome return of SAA has boosted capacity and improved connectivity, particularly for Perth bound or originating travellers. Market capacity will increase rapidly over the coming months as it nears pre-pandemic baselines.

The future remains uncertain with SAA’s well publicised challenges following failures to privatise the state-owned airline. SAA’s leadership has warned that future expansion is in doubt unless new investment is found.

Qantas has seemingly resolved outstanding issues with Perth Airport that scuppered plans to continue their own direct flights from Perth to Johannesburg. However, this may not have come soon enough with capacity returns elsewhere in their network limiting available flying time. Recently, we highlighted how a reorganisation of domestic and trans-Tasman flying has enabled increased utilisation of domestic A330s on long haul flights, but this also highlighted the limited scope for expansion in the short term. Thus, a return of Qantas’s Perth-Johannesburg flight seems unlikely in the near term with Qantas more likely to focus capacity adjustments via frequency adjustments of A380 flights from Sydney.

Qantas’s long haul fleet will remain under pressure for some time, with the first deliveries of 12 Project Sunrise A350s to begin in the middle of 2026, and orders for an additional 12 B787s and 12 A350s to begin arriving in FY2027 and FY2028, respectively. Project Sunrise aircraft are primarily for expansion, but some may displace existing ultra long haul flying on the B787-9, enabling capacity redeployment. The additional B787s and A350s are also designated to replace A330s, but will also provide significant room for expansion as deliveries are expected to outface retirements. Several younger A330s are likely to remain in the fleet for some time and are due for refurbishment.

This will enable Qantas to reconfigure its network for optimal capacity allocation and network effects, allowing various combinations of frequency and city pairs. For example, this may allow the use of smaller aircraft to maintain capacity while returning Sydney-Johannesburg to daily frequency and the return of a lower frequency Perth-Johannesburg service.

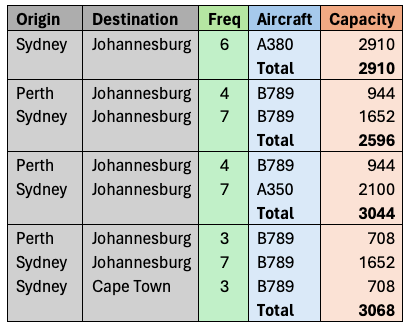

Indicatively, a 6x weekly A380 service provides 2910 weekly seats in each direction. By comparison, if flown by B787-9s, a daily Sydney-Johannesburg service complemented by a 4x weekly Sydney-Perth service would provide significantly fewer weekly seats. With the larger A350-1000 expected to seat at least 300 passengers (not the Project Sunrise low density version), capacity could be maintained by allocating it to the daily Sydney-Johannesburg flight.

It may also open the possibility of new city pairs. For example, Qantas have long been interested in non-stop flights to Cape Town and have frequently teased the route while promoting Project Sunrise. While Cape Town is further west than Johannesburg, it is also significantly further south meaning that Cape Town is actually a touch closer to Sydney and Melbourne than Johannesburg is, however the flight time would be longer due to EDTO 330 track diversions.

The addition of a 3x weekly Sydney-Cape Town flight would provide similar capacity alongside a daily Sydney-Johannesburg and 3x weekly Perth-Johannesburg if flown by the B787s. Qantas could choose to increase capacity with larger aircraft alongside additional frequencies. Alternatively, or in addition, they could also fragment their operation on the Australian side, shifting some Sydney-Johannesburg frequencies to Melbourne, while still maintaining daily connections from Sydney to South Africa.

This is not a prediction, but rather a series of indicative examples to highlight the options that Qantas have at their disposal. A larger and more flexible fleet in coming years opens significant possibilities. A lot may depend on the timing of aircraft deliveries with further delays likely reducing net capacity gains as new deliveries will be required to provide more replacement capacity more, shifting the expansion capacity further down the road.

Secondly, competitive dynamics may evolve. If SAA doesn’t survive, Qantas may find little incentive to increase frequency, preferring to maintain capacity at lower frequencies. Competitive dynamics may also bring Jetstar into the mix with an effort to segment the market. This has not been considered in the analysis, but Jetstar have hinted at the possibility of flights to South Africa after the installation of crew rest areas during the B787 refit.

What do you think? What will the Australia - South Africa market look like a decade from now? New routes? Maybe even new airlines? Let us know in the comments below and share with friends and colleagues. Sharing and subscribing helps us understand what readers are interested in and what they want to read!