Chart of the week #26: Australian international airline seat capacity finally reaches its pre-COVID level

This morning, BITRE released July 2025’s international aviation data, revealing an important milestone: international airline seat capacity has finally reached its pre-COVID level! In the year to July 2025, airlines flying international routes to Australia provided 24.8 million seats compared to 24.7 million seats in the year to January 2020.

While capacity recovered quickly in the immediate aftermath of the pandemic, the recovered slowed significantly in the last year. By the end of 2022, inbound capacity had reached 48% of the January 2020 baseline, and 84% by the end of 2023 and 95% by the end of 2024. It’s been like watching paint dry during 2025!

A bigger and more intriguing question is how the distribution of this capacity has evolved in the post pandemic period. This includes the distribution of this capacity within Australia (between different airports), by airline, and by city and country of origin. There have been dramatic shifts in the distribution of this capacity over the last five years, and we’ll share more on that in the coming days …

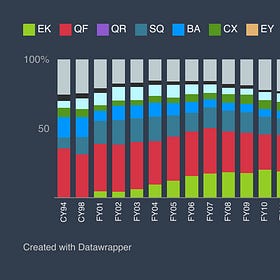

In case you missed it, our last chart of the week looked at how Gulf carriers came to dominate the Australian-UK market over the last two decades. Gulf carriers now dominate the market, accounting for nearly half of the market. Qantas and BA have been the major casualties, although Qantas have done well to recover and increase their market shares in recent years. Transit carriers like Malaysia Airlines and Singapore have suffered large losses.

The more recent emergence of Qatar has thrown a spanner in the works as they now compete effectively with other Gulf carriers, having won significant chunks of market share from Emirates and Etihad. No carriers have been safe!

Chart of the week #25: How Gulf carriers came to dominate the Australia-UK market

Our last chart of the week looked at the most recent Australia-Europe market shares, showing Emirates and Qatar Airways to be the clear market leaders with 30% and 21% market share, respectively, and Singapore Airlines (11%) and Qantas (9%) a distant 3rd and 4th.

Great article with the updated information guys!

Would it also be possible to update the interactive capacity tracker to reflect the new 2025 data?