How constrained are Sydney Airport's slots?

New insights from Sydney's first public Initial Coordination Report

Earlier this year, the management of Sydney Airport’s slots was transferred from Airport Coordination Australia (ACA) to Airport Coordination Limited (ACL). While the names and acronyms are similar enough to be confusing, they are entirely separate entities, with the latter an international entity famous for managing and allocating London Heathrow’s slots.

While the management and allocation of Sydney’s slots has moved to ACL, there have been no meaningful changes in Sydney’s slot system including capacity and slot allocation rules, including the use-it-or-lose-it rule that allows incumbent slot holders to retain a slot provided they utilised it 80% of the time during the preceding season.

ACL is a UK company that was established in the early 1990s to manage slot allocations at the UK’s major airports, specifically London Heathrow. ACL is an independent not for profit company. It has grown to manage slots at 78 airports in 12 countries and is managed by a well-regarded professional staff. Their work is overseen by a board of directors that includes 11 directors:

4 independent directors including the chair

2 executive directors including the CEO and CFO

5 airlines (BA, EasyJet, Jet2, TUI and Virgin Atlantic)

A critique of the board structure is that they represent UK interests. All independent directors are British, while the airline representation on the board reflects the major UK domiciles airlines. Nevertheless, ACL are simply the administrator and individual airports and/or country authorities maintain responsibility for establishing airport capacity including publishing capacity declarations, setting slot rules including slot retention and allocation rules, establishing slot committees, and establishing dispute resolution mechanisms.

There are many similarities between ACL and ACA. While not the same size and scale, ACA was established in 1997, initially to manage Sydney’s slots, and has since grown to manage slots at 7 other airports in Australia (Adelaide, Brisbane, Cairns, Darwin, Gold Coast, Melbourne and Perth) and two foreign customers (Manila and Port Moresby). Its board includes Qantas, Virgin Australia, the Regional Aviation Association of Australia and Sydney Airport, in addition to an independent chair.

Not all airports are slot constrained and slots are an important part of planning and resource allocation. This is evident as of the 78 airports that ACL manage, only 21 are “level 3” airports, while 27 and 30 are level 2 and 1 airports, respectively.

However, one area of meaningful change is with regards to transparency as ACL will now public regular reports, like they do for other airports they manage. Specifically, this includes the Initial Coordination Report which shows slot allocations for the forthcoming season by airline. The Initial Coordination Report provides a macro-level snapshot, for example, showing the number of slots allocated to each airline, but also the number of slots retained and slot, and the applications for new slots that were successful and unsuccessful. However, it doesn’t show specific timings, nevertheless it’s still a substantial improvement in transparency and should be acknowledged.

Notably, the Initial Coordination Report doesn’t segregate the Permanent Regional Service Series (PRSS) slots. PRSS slots are those that are ring fenced for NSW regional services, although these are detailed in a seperate publication.

Insights from the Initial Coordination Report

ACL recently published the Initial Coordination Report for Sydney Airport for the forthcoming IATA Northern Winter 2025/26 season (NW25). NW25 covers 23 weeks beginning 26 October 2025 and ending 29 March 2026 (yes, the IATA Northern Winter is only 23 weeks!).

Airport slots at highly constrained airports like Sydney are invariably complicated and, as we’ve argued elsewhere, they’re often misunderstood in the popular media and even by those who we might expect to have a good understanding. For example, popular wisdom dictates all of Sydney’s slots are allocated, similar to London Heathrow, and that it’s impossible to get additional slots, but this couldn’t be further from the truth!

The Initial Coordination Report for NW25 shows that a total of 143,337 slots have been allocated. This means that only 66% of Sydney’s 218,960 potential slots have been allocated. Potential slots are estimated using Sydney’s cap of 80 movements per hour between 6am and 11pm (Sydney has a curfew), allowing a maximum of 1,360 daily movements. So clearly, the first truth is that Sydney isn’t as full as some might expect!

Comparatively, London Heathrow has 202,793 allocated movements in NW25, utilising 96% of the total capacity of 212,014 potential slots (Heathrow has a fixed annual limit of 480,000 movements). Keep in mind that, in practice, it’s impossible to allocate all slots as there are multiple conflicting constraints on slot allocations, but Heathrow’s 96% is as near as one might get to being full.

So what’s the problem with Sydney then?

While only 66% of potential slots are allocated, close to 100% are allocated at peak times. While the Initial Coordination Report doesn’t allow as to view slot allocations by each airline at specific times, it does allow us to view aggregate allocations over time on each day of the week (actually individual days).

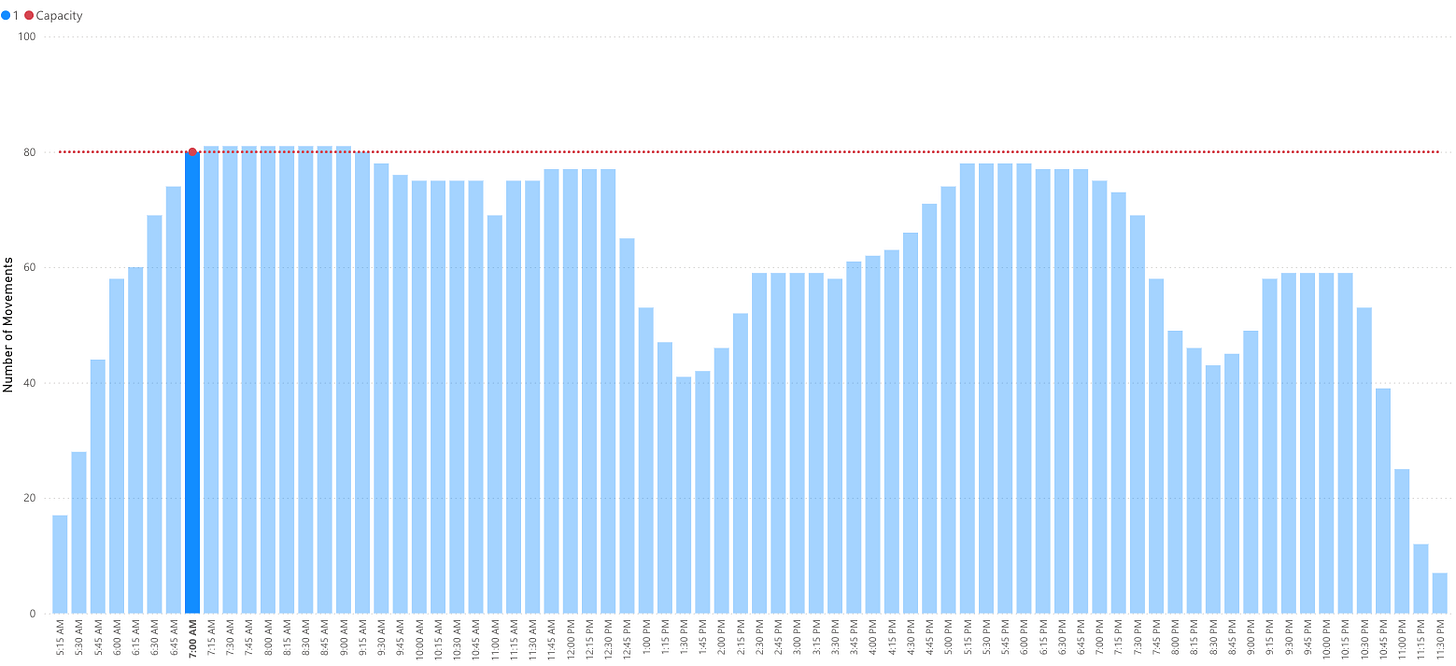

Looking at a typical Monday, we can see how slot allocations vary through the day, with total movements hitting the 80 movements per hour cap during peak periods, specifically the morning peak between 7am and 12:30pm (it’s highest between 7am and 9:15am), and an afternoon peak between 5:15pm and 6:45pm. Other times of day are relatively quieter, with some capacity available before 7am and after 7pm, and ample capacity also available between 12:45pm and 5pm, and after 6:45pm.

An important methodological note is that the 80 movement per hour cap is not 80 in each hour (e.g. 7am to 8am), but any hour on a rolling basis in 15 minute increments (this is what the figure shows). Slots are allocated at a specific time, but must ensure that the rolling cap is maintained meaning that slots on the margins of busy periods are challenging to utilise as it’ll increase the rolling measure before and after. For example, a new allocation in the 9:30am slot (which appears available) is not possible as it’ll push 9am and 9:15am above the 80 movement limit. However, allocating it at 10am would be possible as it’ll only push 9:30am and 9:45am higher, and still be within the cap.

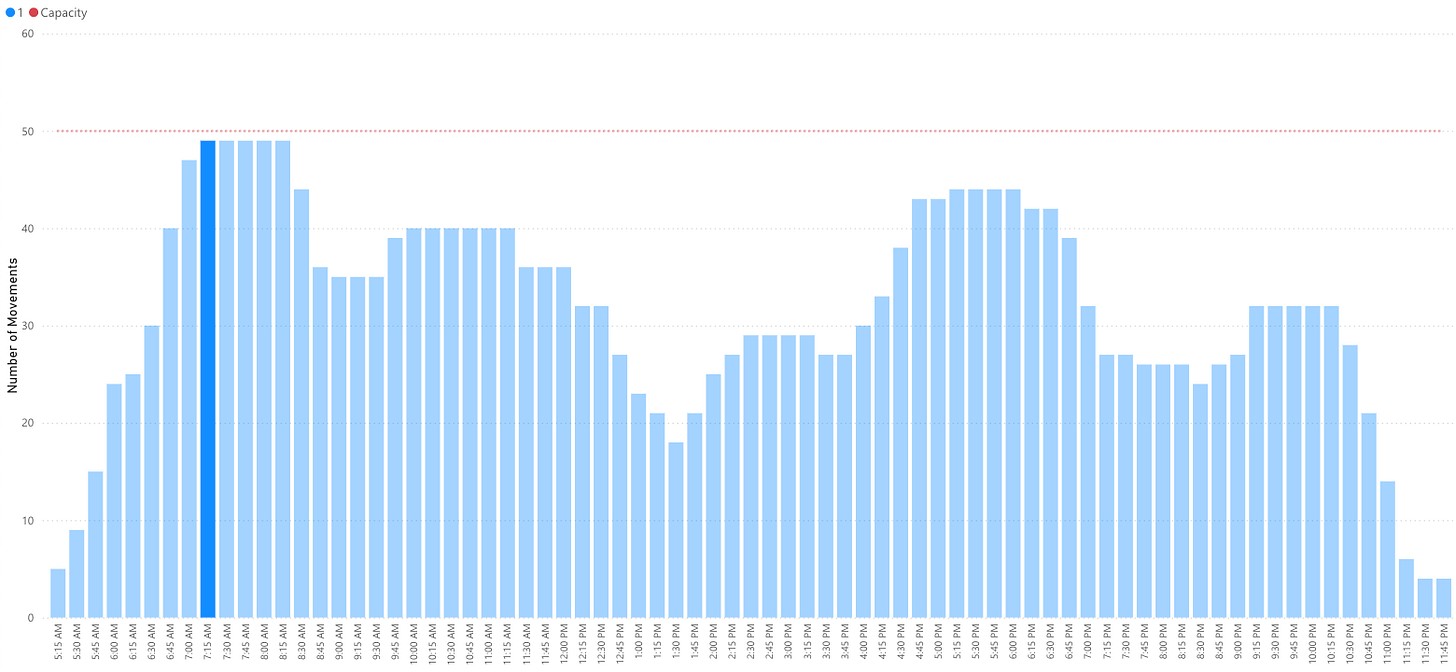

But this isn’t the only constraint! Total movements including both arrivals and departures. While there is a cap on the total movements, there is also a cap of 50 arrivals in each hour. This is neccessary to balance arrivals and departures throughout the day. Looking at arrivals on a Monday, one can see that there’s a little more scope in the arrival cap, meaning that the total movement cap is a more limiting constraint. There are additional constraints, including terminal limits and viable turnarounds, but they are not considered the binding constraint.

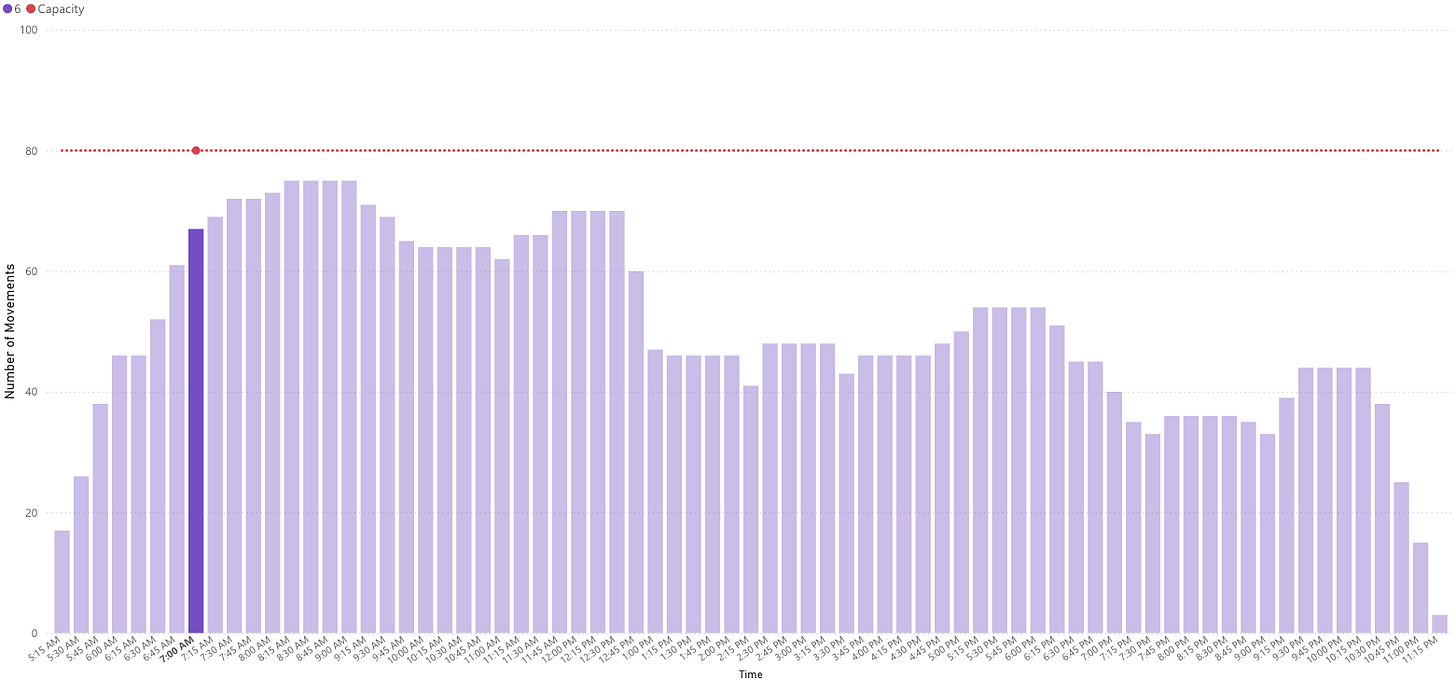

Weekends are also much quieter at Sydney, with total movements not reaching the cap, even during the morning peak hour, on Saturdays. There are ample slots available throughout the day, albeit with some constraints in the morning peak.

What’s clear is that Sydney is very busy, particularly during weekday peak periods, but there certainly are slots available. So the narrative that there are no slots available is rubbish, however clearly there are limits to when those slots are available! This congestion doesn’t affect airlines equally. Let’s consider who this benefits and harms.

Inequalities and inequities

Sydney’s congestion has a dichotomous impact between domestic and international operators. We might argue that it actually has a dichotomous impact between short- and long-haul flights, however domestic and international operators is a close enough proxy for this.

For example, international airlines operating long-haul flights will operate at lower frequencies than domestic operators operating short-haul flights. A quick check on today’s schedule shows Qantas has 34 scheduled arrivals from Melbourne (their busiest domestic route) compared to just 2 scheduled arrivals from Singapore (their busiest international route).

An airline seeking slots for an international flight might only seek one daily frequency and should have no difficult finding a viable slot. They would need to be a little flexible if they wished to operate around peak periods. For example, early morning arrivals are coveted by many international operators who should be able to find an arrival slot before 7am, but would be required to extend their turnaround to around 4 hours. Alternatively, they could arrive after 11am and maintain a more rapid 2 hour turnaround (with some small exceptions during the much shorter evening peak).

A domestic airline isn’t going to be satisfied with one daily flight to/from Sydney. They will want (need) multiple daily frequencies to multiple destinations. Furthermore, they will want (need) these spread throughout the day with short turnarounds to maintain good aircraft utilisation. Unlike long-haul operators, short-haul operators can’t tolerate extended turnarounds as they’re unable to make-up for that with overnight flying.

It should be obvious that it’s simply not possible for a new domestic airline to have immediate access to a useful slot portfolio. It would take a number of years to build a useful and efficient slot portfolio. While we don’t want to downplay the challenge doing this, Rex was able to build a fairly solid slot portfolio for their B737 operations while they lasted.

So it’s not impossible, but how difficult is it?

At the outset we indicated that 143,337 slots have been allocated for NW25 season at Sydney, however another important metric in the Initial Coordination Report is that 130,963 slots were “reclaimed”. This means that 130,963 were maintained by the previous users. Given that only 139,019 were allocated for the previous season (NW24), this means that 94% of slots were retained.

Since only 130,963 of the 143,337 slots were reclaimed this means 12,329 new slot allocations were made, meaning that 9% of all NW25 slots were newly allocated. So, it’s not impossible!

Back to the unclaimed slots: 8,066 were unclaimed. There are several reasons that slots can be unclaimed, but the primary reasons are the operator going out of business, the holder voluntarily relinquishing the slot, or the holder being unable to satisfy the 80% use-it or loose-it rule! The largest contributors to unclaimed slots in NW were Rex (5,650) and Qantas Group (1,415). This is not surprising since Rex and Qantas Group are amongst the largest slot holders at Sydney, and Rex’s administration has severely impacted its flying schedule.

While there were 12,329 new allocations made, airlines actually applied for 12,652 slots, meaning that 97% of all requests were allocated. This is an incredible figure actually! Moreover, the total allocation is 53% greater than the number of unclaimed slots, supporting our previous finding that while Sydney is congested, it’s not full.

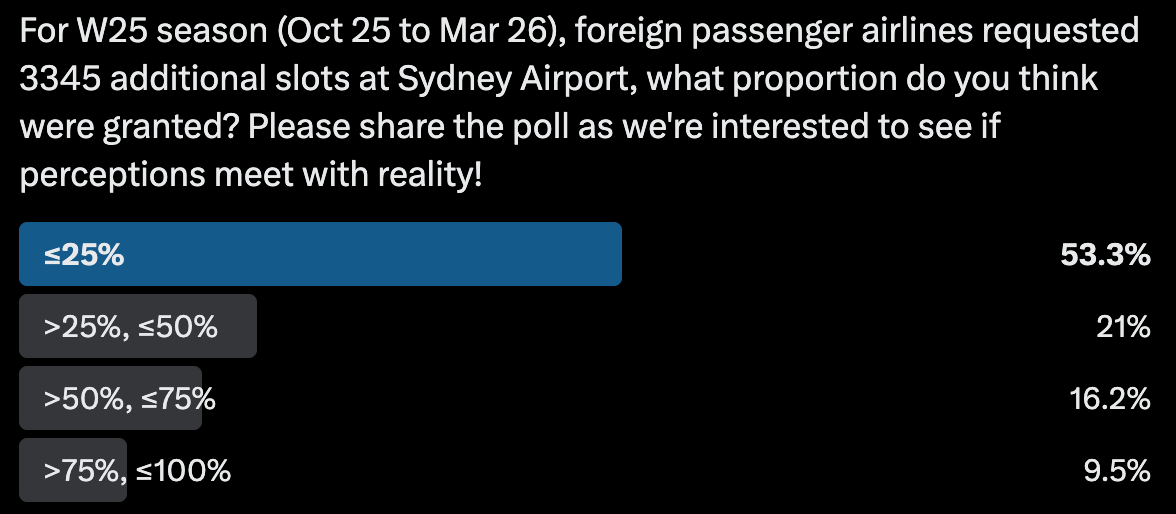

Notably, all foreign passengers airlines received their total requested allocations. Of the 3,345 applications from foreign passengers airlines, every single slot was allocated. This shouldn’t be surprising given our analysis, however it runs counter to the perceived wisdom in the public discourse. To highlight this, a few weeks back we ran a quick poll on Twitter to test this. Only 9.5% of respondents guessed that it was greater than 75%, while the majority of respondents assumed that few airlines get their requested slots.

Only 323 individual slot applications were denied, which amounts to approximately one daily return flight though the season! Notably, 90% of those slot denials belonged to the Qantas Group, but that isn’t surprising since they are the largest slot holder at Sydney. But just how dominant are they?

Qantas and Jetstar hold a combined 52% of all allocated slots at Sydney (36% and 16% individually), compared to Virgin and Rex’s 20% and 8%, respectively. Other carriers hold the remaining 20%. Even if we include Qantas and Jetstar’s joint venture partners (American Airlines and Emirates), this only increases to 54%.

Comparatively, British Airways and other IAG airlines (Aer Lingus, Iberia and Vueling) hold 55% of Heathrow’s allocated slots, increasing to 61% including their joint venture partners (American Airlines, China Southern, Finnair, Japan Airlines and Qatar). BA’s largest competitor, Virgin Atlantic holds only 5% of Heathrow slots, or 9% when including their joint venture partners (Air France, Delta and KLM).

While Qantas and BA have a similar share of slots at Sydney and Heathrow, respectively, this is somewhat misleading as Qantas’s largest local competitors hold 28% of all Sydney’s slots, whereas BA’s only hold 9% of Heathrow’s slots. Furthermore, Qantas’s local competitors have somewhat better prospects of gaining additional slots compared to BA’s local competitors.

But what does this mean?

Before anyone gets the wrong idea, we’re not saying that Sydney is not congested or slot constrained. In fact, we’d argue that it’s one of the most slot constrained airports in the world. But it’s simply not in the same league as some other slot constrained airports like London Heathrow.

While it’s difficult to get Sydney slots, it’s not impossible, and it’s certainly very difficult to build a useful slot portfolio quickly. And to be fair, start-up airlines don’t have the luxury of time. Furthermore, the challenges faced by domestic operators aren’t the same as international operators.

Enter Western Sydney International Airport

Sydney’s 2nd airport is nearing completion and is scheduled to open in late 2026. We’ve made the point before that we anticipate that Western Sydney will be predominantly a domestic airport for the foreseeable future. While we expect a handful of international flights, we don’t expect an influx as slots aren’t the same constraint for international carriers in Sydney as they are at Heathrow or some other airports around the world.

Foreign carriers interested in Western Sydney will be those attracted by the alternative catchment or lack of curfew, but not slot availability. For example, Singapore Airlines and Air New Zealand have been announced as the first international carriers at Western Sydney, but these flights will supplement their Sydney operations rather than replace them. Singapore already operate 4x/day flights to/from Sydney in addition to 1-2x/day flights by their subsidiary Scoot, while Air New Zealand operate up to 7x/day flights to Auckland, Christchurch, Queenstown and Wellington.

Meanwhile, we expect Qantas, Jetstar and Virgin to ramp up their domestic schedules to/from Western Sydney quickly. Furthermore, we would expect a high concentration of flights at Western Sydney during Sydney’s peak times! While the alternative catchment and lack of curfew might be useful, their primary interest is alleviating Sydney’s slot scarcity during peak periods.

We don’t expect everyone to agree with our analysis and conclusions as this is a somewhat controversial topic. However, the data is real and we hope, at the very least, that this analysis helps dispels some of the myths or perceived wisdoms regarding Sydney’s slots. Hopefully, at least we can agree that it’s far more complicated than some of the simplistic narratives that have evolved in recent times!