Is capacity between Australia and the US normalising?

The Australia-United States market has been one of the most interesting major air travel markets to/from Australia since the COVID-19 pandemic. While capacity and passenger numbers have returned strongly in most major markets several have lagged. In most cases, the lag has been due to slow border reopening in other countries (e.g. China and Hong Kong). In two specific cases - the US and Japan - a slow return in demand was due to currency fluctuations that have led to vastly different market changes.

The relative strength of the US Dollar weakened Australia-US travel. As our in-depth analysis in May highlighted, the dominance of the Australian point-of-sale led to a sharp decline in capacity between the countries as Australians reduced travel to the US owing to it being relatively more expensive as a destination. While US based carriers may have anticipated an increase in US point-of-sale travellers in return this didn’t materialise leading to an over capacity in the market.

Thanks to a treasure trove of public data we were able to analyse airline performance by route and by direction on a monthly basis. This showed how United Airlines made a big play with a dramatic increase in capacity. However, many seats went empty with United posting a load factor of just 49% and 48% to and from the US in November 2023. On one route, their load factor was as low 38% and 39% to and from the US in November.

United’s performance wasn’t unique! All airlines suffered from market-level over capacity and saw their load factors decline, however United’s performance was extraordinary as they were responsible for much of the additional capacity. Qantas, American and Delta’s saw load factors in the 60s and 70s during the same time as they managed capacity more pragmatically.

What about Japan?

The relative strength of the Australian Dollar versus the Japanese Yen has made Japan relatively cheaper for Australians and Australia relatively more expensive for Japanese visitors.

Unlike the Australia-US market, Australia-Japan market is more buoyant. So while Japanese demand to Australia declined, Australian demand to Japan has increased. A more balanced point-of-sale has meant demand flows have adjusted dynamically.

While not a comprehensive analysis, we covered the increase in passenger number to Japan in August:

Our detailed analysis in May sought to understand United’s strategy and highlighted airline level capacity. United had a lot of long haul capacity that needed to go somewhere given their exposure to the slower recovering Asian market. The analysis considered a range of novel data to establish the Australian point-of-sale bias that wouldn’t have been obvious to readers.

So why are we returning to it now? Firstly, our previous analysis was incomplete as it was limited by data availability. Data was only available through January 2024. With data now available through July 2024, it’s an opportune time to consider the complete NW 2023-24 season.

Secondly, we are now able to get a better picture of airline scheduling for the NW 2024-25 season. As the schedule has taken shape, it’s given us some insight into how airlines are reacting to the NW 2023-24 season performance and what their goals may have actually been.

This is particularly interesting given Qantas’s recent announcement of an expansion in US flying, albeit a year from now with the A380 returning to Sydney-Dallas and an increase in frequency of Melbourne-Dallas. Why are the notoriously conservative Qantas increasing capacity when everyone was bleeding? Let’s dive in …

How did the rest of NW 2023-24 go?

Our previous analysis included data through January 2024. Additional data is now available through July 2024. Two periods are relevant, firstly the remainder of the NW 2023-24 season through March, and the start of NS 2024 from April running until October.

Capacity began to step down in February and March, primary led by United with capacity off their seasonal peak capacity in December and January. American and Delta maintained capacity through the end of NW 2023-24, while Qantas’s capacity declined in February but returning to peak levels in March.

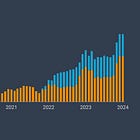

Over the complete NW 2023-24 (five month period from November 2023 through March 2024), capacity was dramatically higher than NW 2022-23, with 346,000 or 36% more round-trip seats. United provided 51% of this incremental capacity, increasing their seat count by 41%. Qantas provided 33% of incremental capacity, increasing their seat count by 35%. American increased their seat count by 42%. Coming off a smaller base meant a smaller 14% contribution to incremental capacity.

Capacity declined sharply beginning in April as US carriers implemented seasonal capacity reductions. A reminder from our previous analyses, US carriers have tended to make significant seasonal adjustments responding to greater seasonal variations in demand from the US point-of-sale. Qantas don’t adjust their capacity to/from the US significantly as there is less seasonal variation in the Australian point-of-sale.

So far, the four months of NS 2024 have seen capacity broadly aligned with NS 2023 with 33,000 more round trip seats supplied, an increase of 5%. United and Qantas have both increased capacity 6%, while Delta and American have reduced capacity marginally.

Our previous analysis highlighted that capacity increases did not generate commensurate increases in passenger numbers, resulting in dramatic declines in load factors through January 2024. As the largest contributor to capacity increases, United experienced the most dramatic decline in load factors. United observed a 49% load factor in November 2023, improving to a still disappointing 60% and 65% in December and January. Comparably, Qantas and American fared better reaching a low of 71% in November. This was still significantly lower than the 82% and 84% they generated the previous year.

These trends continued in February and March. Over the complete NW 2023-24 (five month period from November 2023 through March 2024), the market level load factor was 65%, compared to 78% observed during the period year. As expected, United’s performance was the worst at 59%, compared to 76% in NW 2022-23. Delta were not far behind with a season load factor of 65% compared to 80% the previous year. Qantas and American will be somewhat pleased with their relative performance of 71% and 75%, respectively. Compared to United and Delta they’ll take the win, but the degradation from 81% and 80% year-over-year shows the market-level impact of over capacity.

Loads have recovered since the start of NS 2024 with a market average of 77% in the four months between April and July, marginally lower than the 78% in the same period the previous year. United, Delta and Qantas’s loads are slightly lower than the previous year, while American has experienced an increase from 77% to 82%.

Before we jump to conclusions, we must recognise the limitations of analyse load factors. They can be a naive metric since it normalises the data relative to capacity. By examining load factors one might conclude that Delta performed nearly as poorly as United, however this obscures the magnitude and scale of United’s capacity. United’s performance is simply more consequential than Delta’s given the relative magnitude and scale.

Another way to examine this is the absolute number of empty seats that each carrier flew. This metric shows the magnitude and scale of over capacity, and the relative consequences. The result is a little wild!

During NW 2023-24 there were 462,000 empty seats on flights between Australia and the US, compared to 211,000 the previous year. More than half of those empty seats (255,000) were on United. While Delta’s relative performance was poor, it only accounted for 57,000 empty seats, highlighting their smaller contribution to over capacity, and likely smaller losses as a result.

Contextualising the poor performance further we can estimate the incremental effects. United provided an additional 178,000 seats during the period, but carried only 29,000 more passengers, meaning an incremental load factor of 16%. For every 100 additional seats they added they only carried 16 additional passengers! Meanwhile, Delta and Qantas generated incremental load factors of 32% and 42%, respectively. American generated a negative incremental load factor, carrying fewer passengers despite more capacity, although the magnitudes are not significant.

Incremental load factors reinforce just how bad United’s performance was. Even when considering a small recovery in early 2024 there is no doubt over capacity led to the poor performance. Without a shadow of a doubt, the led the over capacity and suffered the most as a result. NS 2024 has so far seen a normalisation of capacity and performance, but there is no evidence that suggests a recovery.

Big capacity reductions for NW 2024-25 season

Over the last few months we’ve seen an evolution in the NW 2024-25 schedule. This includes some network realignment with different carriers making scheduling adjustment to exploit comparative advantages in their networks and increased collaboration between partner airlines. Other adjustments are blunt capacity reductions responding to NW 2023-24’s performance.

Delta announced a new 3x weekly seasonal route between Los Angeles and Brisbane, partially offsetting frequency reductions in their seasonal 2nd daily Los Angeles-Sydney flight. Some have speculated that this exploits subsidies from the Queensland government but there are also other likely benefits for Delta given their weaker domestic feed in Australia.

American surprised commentators by adding a new daily flight to Brisbane from Dallas. This complements the successful Qantas flights from Melbourne and Sydney to Dallas. Dallas is American’s largest hub and provides more connecting options, more efficiently than Los Angeles. This reinforces the steady shift in capacity from Los Angeles and San Fransisco to Dallas, highlighting the growing importance of the joint venture to Qantas and American.

While American will operate the flights, the joint venture will allows exploitation of Qantas’s point-of-sale dominance in Australia, and the Australian point-of-sale bias at the market level. It is likely an important factor in American and Qantas’s relatively better performance compared to United and Delta.

Finally, United appear to have taken the lesson from NW 2023-24, dramatically reducing their scheduled capacity for NW 2024-25. This includes shorter seasons for seasonal capacity increases (i.e. starting later or ending earlier), and reduced frequencies and aircraft size. Their only capacity increase is between San Fransisco and Brisbane, however this partially offset the loss of capacity resulting from the cancellation of their Los Angeles-Brisbane flight.

Looking at the month of December 2024, United are scheduled to provide nearly 18,000 fewer seats (one way ex-Australia) than December 2023, representing a 26% capacity reduction. However, market level capacity is only expected to be decline 12,000 seats (9% increase) as American will increase capacity by nearly 9,000 seats (94% increase).

Broken down by city, one clearly sees how Brisbane is the big winner, taking a significant chunk of capacity from Sydney and to a lesser extent Melbourne.

Another interesting but observation is the timing of schedule changes. Capacity reductions were not immediate indicating that airlines (particularly United) were willing to sustain capacity increases had they been more successful!

As far back as May, United’s December 2024 schedule was almost identical to the actual capacity provided in December 2023. Major changes and capacity reductions were to the schedule were only implemented in June. Since then there have been smaller refinements resulting in further and smaller capacity reductions. Delta have implemented similar changes in recent months while American and Qantas have maintained consistency in their forward scheduling.

Don’t be too quick to judge United!

The data in provided in this update reinforce the findings of our previous analysis. We’ll give some time to digest these data before delving into the more granular route level performance next when when we’ll share route level load factors, showing performance by airline, route, direction of travel in each month.

More importantly, this update also highlighted further nuances in the data that have appeared or been reinforced with time. On a superficial level the data and analysis suggests that United got it badly wrong! They dramatically increased capacity but failed by only filling 16% of that incremental capacity. That is a poor performance by any stretch of the imagination!

We previously proposed a hypothesis that United made a strategic decision to maintain and even grow long haul capacity during the pandemic and that the slow return of US-Asia travel generated a particular challenge for them. As the largest US carrier between the US and Asia they had to find somewhere to send this capacity instead. Australia was just one of these markets but performed particularly poorly due to the strong US dollar combined with Australian point-of-sale dominance.

This is supported by the delay in pulling back capacity for NW 2024-25 with much of the capacity reduction only occurring four months before the start of the NW 2024-25 season. We may be over interpreting the timing with the forward looking schedule being automatically loaded and only adjusted once other schedule adjustments - including increases to Asia - were ready to be loaded. But this leads to another hypothesis.

Despite the schedule reduction for NW 2024-25 United will provide significantly more capacity compared to their pre-COVID baseline. For example, they will provide 14,000 more seats in December 2024 compared to December 2019, an increase of 41%. In our last analysis we floated the idea that United’s capacity increase may have been intended to (partially) offset the capacity loss of their now partner Virgin Australia who withdrew from long haul flying during their bankruptcy process in 2020.

United’s December 2024 capacity is still lower than United and Virgin’s combined December 2019 capacity, however the data indicate that United have captured a big chunk of Virgin’s capacity! Current schedules show that United will increase their market share of capacity from 24% to 39% between December 2019 and 2024 (42% to 39% when including Virgin).

Let’s not be naive - this is a win for United! A very expensive win but a win nonetheless and one that may have been part of the strategy! While they probably did not anticipated such a poor performance it was likely considered an acceptable risk to partially retain Virgin’s share of capacity and increase their own market share.

It’s quite possible that United achieved an important goal. We’re somewhat less critical of United now than we were in May. However, they still need to fill these seats and fill them at a good yield to justify the gain. Increasing market share at all costs isn’t worth it and we’ll reserve judgement a little longer. There may have been some method to the madness than was originally obvious.

Meanwhile, Qantas and American’s pragmatism has resulted in a decline in their market share of capacity from 52% to 49%. They are probably happy with this outcome and would argue that it wasn’t worth degrading yields to defend 3 percentage points. This is reinforced by their newfound confidence, with additional capacity coming online in NW 2024-25 and already announcing further capacity increases for NS 2025.

In July, we joked on Twitter that there must have been a celebration at Qantas HQ when United announced major capacity reductions. Dare we say this is still the case, certainly advantage Qantas, but United are still in the game!

Analytic Flying is free! There is no subscription required to read this analysis or anything in our achieve. Please subscribe to a free subscription to get immediate access to the latest posts. And please share it widely with friends and colleagues.

Paid subscriptions are also available - it’s voluntary and helps us publish more high-quality analyses, more frequently. Thanks for your support!