Is Jetstar’s A321neo Long Range Qantas’s saviour?

On 19 December 2023, Jetstar took delivery of its 11th A321neoLR (Long Range) aircraft. With 232 seats, the LR is significantly larger than the 180 seat A320ceo that are the mainstay of Jetstar’s fleet. More importantly, the LR boasts a significantly longer range and improved fuel efficiency compared to the A320ceo and A321ceo, helping Jetstar expand capacity by displacing B787-8 flying on medium-haul routes and allowing the B787 to be redeployed on longer routes. This blog explores why the LR is quickly becoming the most important aircraft to the Qantas group.

A321ceo or neo, what is the difference?

Airbus announced an improved version of the incredibly successful A320 family in December 2010. The upgrades include a substantially new engine technology employing a “geared turbofan”. This led to the renaming of the aircraft as the A320neo, a play on words on the Greek word neo meaning new, but also an acronym for new engine option. As a result, the existing A320 family became colloquially known as the A320ceo, or current engine option.

The A321neo has continued to evolve. In early 2015 Airbus launched the LR with a promise of increasing the A321neo’s range from 3,500 to 4,000nm. This was achieved by additional fuel tanks and increasing the maximum take-off weight (MTOW) to lift that extra fuel. However, the stated range of 4,000nm is somewhat misleading since this doesn’t imply that the aircraft can fly a full payload this distance. Under optimal conditions (departure at sea level at a temperature of 15C), the LR will carry its maximum payload approximately 2,500nm. Between 2,500 and 4,000nm operators are trading fuel for payload. How does this work?

The LR has a MTOW of 97t and an empty weight (OEW) of approximately 50t although this will vary depending on the aircraft’s layout and ammenities.

The remainder (47t) can be made up of a combination of fuel and payload (crew, passengers, catering, baggage, cargo, etc).

Maximum fuel capacity is 26t, coincidently the maximum payload is also 26t.

A full fuel load and payload would amount to 52t, resulting in a take off weight (TOW) of 102t (OEW + payload). This exceeds the MTOW of 97t by 5t.

Thus, either the payload, fuel load, or a combination of both needs to be reduced by 5t. This induces a trade-off between fuel and payload.

Airlines have different aircraft configurations and crewing specifications, but the most significant predictor of payload is the passenger load. The passenger mix also affects the payload, as do different baggage practices. Catering is correlated with passengers numbers, but also affected by the specific route. It would be rather speculative to estimate Jetstar’s payload needs on each route, but safe to say, their high-density configuration is relatively heavy. However, a full payload (26t) allows only 21t of fuel to be lifted, likely sufficient for 6 to 7 hours flying time. This does not even account for the possibility that the aircraft’s TOW may be restricted due to weather conditions or runway limitations at origin or the need to carry additional holding fuel.

So where is Jetstar flying the LRs?

The LRs are mostly plying international routes with several domestic services used for aircraft positioning and to maintain high aircraft utilisation. On international routes, they spend a lot of their time flying to Bali (DPS) with multiple daily flights from Adelaide (ADL), Melbourne (MEL), and Sydney (SYD). Other flights include less frequent flights from Sydney to Nadi (NAN) and Rarotonga (RAR). The longest of these is SYD-RAR at 2,695nm, well within the range of the aircraft.

The LR is displacing B787s on the MEL–DPS and SYD–DPS routes and displacing A320s on ADL–DPS. The A320 is at the edge of its range on ADL–DPS and likely operates with significant payload penalties. SYD–NAN and SYD-RAR are new routes for Jetstar, and in the case of the latter wouldn’t have been viable on the A320.

In the coming year the LR is schedule to displace further B787 flying, including additional MEL/SYD–DPS flights and BNE–DPS. Furthermore, they will also displace other A320 flying, including Perth to Bali and Singapore, and open new routes including Melbourne to Nadi, Perth to Bangkok (BKK), and Perth to Phuket. PER–BKK will exceed SYD-RAR as the longest LR sector at 2,864nm.

The LR isn’t a one-for-one replacement for the B787

Many observers often look at airline fleet replacement and consider future orders on a one-for-one basis, but this couldn’t be further from the truth. While some aircraft are designed as like-for-like replacements, evolving technology and market dynamics have led to increasingly adaptable and flexible aircraft over time, and the LR is a prime example. While the A320ceo family was clearly developed as a short haul aircraft, the A321neo is a platform for both short and medium haul.

The LR is substantially smaller than the B787s, each carrying 232 and 335 passengers, respectively, in Jetstar’s configuration. Over week, a daily route flown by the LR carries 721 fewer passengers in each direction than the B787. To match the B787s capacity, Jetstar will have to fly 10 weekly LR flights to carry (roughly) the same number of passengers (see Table 1).

And this is exactly what Jetstar is doing, increasing frequency on key routes (e.g., BNE–DPS and MEL–DPS) to maintain capacity as they displace B787s with LRs. This strategy is possible due to the idiosyncratic Australia-Indonesia Bilateral Air Services Agreement (BASA) that requires Qantas to carefully manage their Indonesian capacity at a group level. Let’s consider this in more detail.

Case study: Qantas group’s Indonesia operations

The Australia-Indonesia BASA has fixed capacity limits on flights from MEL, SYD, BNE and PER to Indonesia. Capacity is allocated at a group level, requiring Qantas and Jetstar to share their allocation, allowing them to switch capacity between brands, origin, and destination as needed. For example, if Qantas wish to increase capacity on Melbourne-Jakarta (CGK), it will have to reduce capacity elsewhere, possibly on Jetstar’s MEL–DPS service.

There are no limitations on frequencies, aircraft size, or destination meaning that Qantas and Jetstar have significant flexibility but must monitor schedules on a weekly basis to ensure they remain within limits. They also need to maintain at or near the limit to avoid losing capacity allocations. At present, Qantas have 20,076 seats per week in each direction for the restricted routes, having increased from 19,406 in 2020 (IASC granted an extension for implementation to 2022).

Meanwhile, flights from all other Australian points (e.g., ADL, CNS or DRW) are excluded from capacity limits allowing Qantas and Jetstar to fly unlimited capacity on these routes.

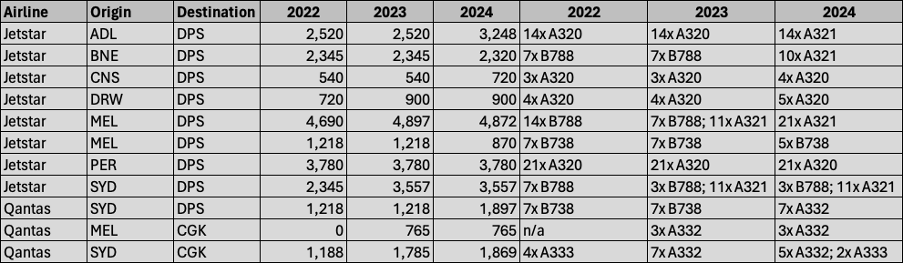

At present, Jetstar fly to DPS from ADL, BNE, CNS, DRW, MEL, PER, and SYD, while Qantas also fly from MEL and SYD to DPS, in addition to flights from both MEL and SYD to CGK. Frequencies and aircraft type vary substantially over time with some seasonal variations. In order to make a like-for-like comparison, we’ve chosen to look at the weekly capacity for the same week in July for 2022, 2023 and 2024 (Table 2).

At a group level, Qantas have substantially increased weekly seat capacity to Indonesia in recent years. Increases have occurred on both brands, but notably increases in restricted routes have been limited by the capacity limitations of the BASA allocations. Notably, they have continued to increase capacity on unrestricted routes (we’ll come back to this a little later).

The increased capacity has been driven by increased frequencies by both Jetstar and Qantas, combined with variations in average aircraft capacity. Table 3 shows how Jetstar have reduced the use of both the smaller A320 and larger B787, but increased the use of the oLR resulting in a net increase from 70 to 89 weekly frequencies between 2022 and 2024. Jetstar’s average aircraft capacity (total capacity divided by total frequencies) declined from 242 to 218 seats between 2022 and 2024 (see Table 4).

The impact of the LR is obvious: between 2022 and 2024, Jetstar increased their seat capacity by 15% while increasing frequency also 26%, coinciding with a decline in the average seats per frequency of 10%.

Meanwhile, Qantas increased frequency considerably between 2022 and 2023 before declining marginally in 2024, this has been counterbalanced with a significant increase in average aircraft capacity.

Table 5 shows the detailed route specific frequencies and aircraft allocations. It highlights examples of how Jetstar have been able to broadly maintain capacity on routes while withdrawing the B787 and replacing it with the smaller LR.

For example, BNE–DPS was operated by a daily B787 in 2022 and 2023, providing 2,345 seats per week. In 2024 however, the B787 was replaced with the LR with frequency increasing to 10x weekly providing 2,320 seats per week.

A similar example is MEL–DPS, where 2x daily B787 provided 4,690 seats per week in 2022. In 2023, one of the daily B787 rotations was replaced with 10x weekly LR delivering 4,897 seats per week, a slight increase. In 2024, the B787 was withdrawn entirely, with the LR now operating 3x daily delivering 4,872 seats per week.

In total, Jetstar reduced the number B787 flights to DPS from 28 to 3 per week between 2022 and 2024, replacing them with 56 weekly LR frequencies (that also includes displacement of 12 weekly A320 rotations). The net effect has been a significant increase in Qantas’s group capacity between Australia and Indonesia.

Increased frequencies may generate additional benefits with increased network connectivity and greater customer choice provided the schedule is fragmented sufficiently to offer a broader range of times and options. But does flying more frequencies result in greater economic efficiencies?

The LR will burn less fuel per passenger than the B787 since the B787 is a much larger and heavier aircraft optimised for longer range flying. However, Jetstar will forego significant cargo capacity and the larger number of frequencies to achieve the same capacity will generate additional crew costs. These need to be netted off against each other at a group level over a relatively long period alongside a range of other costs.

However, the real benefit for the Qantas group is the redeployment of the B787 on longer routes given the significant shortage of long haul capacity in the Qantas group. These have been well publicised with substantial debate and criticism regarding Qantas’s decision to retire the B747-400, the reduction in the A380 fleet, the decision to convert two A330-200s to freighters, and the slow return of stored aircraft. So where are they B787s going?

The LR is opening up new flying opportunities for Jetstar’s B787s

Jetstar’s B787 fleet has historically been deployed mostly on routes to Southeast Asia, primarily from CNS, MEL and SYD. Routes are typically focussed on outbound (e.g., BKK, HKT and Honolulu (HNL)) and inbound leisure destinations (e.g., CNS-Tokyo Narita (NRT) and CNS-Osaka Kansai (KIX)).

A secondary strategy is the fragmentation of low yield traffic between the Qantas and Jetstar brands. This includes Jetstar flying lower yield destinations like Ho Chi Minh City (SGN) in Vietnam, or supplementing Qantas mainline services to Singapore or Seoul, South Korea (ICN). In 2019, Jetstar flew 49 weekly frequencies on the B787 (excluding Indonesia), from 4 points in Australia to 7 foreign destinations in 5 countries, offering 11 city pairs (Table 5).

In 2024, Jetstar will fly 69 weekly frequencies on the B787 (excluding Indonesia), from 4 points in Australia to 8 foreign destinations in 6 countries, offering 14 city pairs. This will be achieved through frequency increases on several routes (BNE-NRT and MEL–BKK/HKT/SIN; note that previous OOL routes have been shifted to BNE) which offset frequency reductions (MEL/SYD-HNL).

This has also enabled the opening of new destinations and routes, including ICN and KIX (from both BNE and SYD). The addition of SYD-KIX is particularly intriguing in that it is a former Qantas route that has not returned post-pandemic. Is this a permanent shift from Qantas to Jetstar exploiting yield fragmentation, or is this a case of Jetstar temporarily filling capacity for Qantas? Only time will tell.

The expansion of Jetstar’s long haul B787 flying is substantial with a 41% increase in weekly frequencies on long haul routes enabled by the introduction of the LR on flights to Indonesia. While the analysis is forward looking, the impact on Jetstar’s international capacity is already being seen.

Exploring data from our Capacity Tracker tool, Jetstar’s 2023 international seat capacity on the routes in Table 5 was 9% higher than 2019, and 11% higher over the last quarter.

Conclusion

In a short space of time, the A321neoLR has made a remarkable impact at Jetstar and consequently the Qantas group. The exceptional capability of the aircraft has filled a niche allowing Jetstar to maintain capacity on capacity limited but frequency unlimited medium haul routes to Indonesia.

These routes were previously outside of the range of their densely laid out A320s, requiring the use of the B787. The introduction of the LR has allowed the redeployment of the B787 on longer range routes, allowing Jetstar to significantly increase capacity to Southeast Asia. The net effect has been a substantial increase in Jetstar’s total international seat capacity of 6% in 2023 (compared to 2019).

This has also led to benefits a group level leading to the hyperbolic question in the blog’s title being framed as the Qantas Group’s saviour rather than Jetstar’s. In addition to Jetstar’s capacity increases, the capacity redeployment has enabled Jetstar to backfill some Qantas international capacity at a significant cheaper cost than other short term measures including additional ACMI leasing. Furthermore, it has significantly advanced the group’s strategy of yield fragmentation between the two brands, further shifting lower yield traffic onto Jetstar, allowing Qantas to further focus on high yield traffic and routes.

Jetstar have several more LR on order for delivery the next two years. There appears limited scope to displace further B787 flying to Indonesia although Jetstar may venture further, flying the LR further yet. What other routes might it displace the B787 on?

Alternatively, the additional aircraft might displace existing Qantas flying, potentially some of Qantas’s own Indonesia flying, or used elsewhere for expansion or new routes by Jetstar.

Subjectively, the LR is the most important new aircraft to the Qantas group in many years. The timing has also been somewhat fortuitous, coming at a time when capacity was desperately needed. However, the capability and flexibility of the aircraft is not fortuitous and was a key factor in Qantas’s decision bet its future the A320neo family.