Dismal prospects for trans-Tasman competition

Over the last few months we’ve seen Qantas and Jetstar come out swinging with new routes and capacity increases across its trans-Tasman network. This includes Qantas’s forthcoming returns to Perth-Auckland and Adelaide-Auckland in addition to seasonal increases across its existing network. In addition to increases across its existing network, Jetstar has also added several new routes including Cairns-Christchurch, Gold Coast-Hamilton, Gold Coast-Dunedin, Sydney-Hamilton, and Brisbane-Queenstown. In 2025/26, Qantas and Jetstar will add more than 800k seats to its trans-Tasman schedule, a 20% increase compared to 2024/25, already their highest ever annual capacity. While we always encourage capacity increases, the reasons for these increases are concerning, painting a dismal picture for competition on trans-Tasman flights in the coming years. Let’s explore …

Is demand increasing?

In 2024/25, the ABS reported 2.8 million arrivals in Australia from NZ, an increase of 5% over the previous year, but still 2% below the pre-pandemic peak in 2018/19. Meanwhile, BITRE reported 3.4 million arrivals in Australia on flights from NZ in 2024/25, a 5% increase over the previous year, yet still 6% below the pre-pandemic peak (also in 2018/19). Notably, the pre-pandemic period showed consistent growth of 32% (ABS) and 33% (BITRE) between 2009/10 and 2018/19.

Given the slow pace of recovery in trans-Tasman demand, Qantas and Jetstar’s capacity increases seem rather bullish, provoking several questions:

Is the slow pace of recovery due to a lack of supply, or is demand just weak?

Why are passenger flows reported by BITRE so much larger than ABS’s arrivals?

The questions are proposed in order of importance, however answering the second helps us with the first. The difference between ABS and BITRE data is attributable to transit traffic, i.e. passengers traveling to/from NZ through Australia (e.g. Auckland-Melbourne-Bali), and passengers traveling to/from Australia through NZ (e.g. Brisbane-Auckland-Los Angeles). In 2024/25, BITRE reported 571k more arrivals than ABS, meaning that there were approximately 571k from passengers traveling to/from NZ through Australia than there were passengers traveling to/from Australia through NZ. The pattern of this flow has been consistent over time, however the absolute and relative magnitudes have varied.

Net transit traffic has declined in both absolute and relative terms. In 2024/25, net transit accounted for 17% of the total traffic on trans-Tasman routes, having declined from 21% in 2018/19 and a peak of 23% in 2014/15 and 2015/16. Several factors may account for the decline, but most likely due to weaker demand between Australia and the US, and Air NZ’s fleet challenges that are limiting their ability to fulfil historic NZ-US capacity. We’ve covered these topics extensively (see below).

While this helps explain the decline in BITRE flows, it doesn’t explain the decline in ABS flows which are indicative of a decline in O&D traffic. Conceptually a reduction in Australia-US transit traffic via NZ opens capacity for O&D traffic, however the decline in the proportion of net transit traffic indicates that more capacity has been lost from the market than the decline in net transit traffic. This reinforces the importance of our first question, raising the prospect that demand been constrained by a lack of supply?

Tight market supply would lead to higher prices and reduce demand. This is difficult to directly measure, however increasing passenger load factors and prices support this hypothesis. Excluding 5th freedom carriers (see explanation below why we exclude them), the trans-Tasman aggregate load factor increase from 76% in 2018/19 to 83% in 2024/25.

Meanwhile, Air NZ reported unit revenues and yields increasing 41% and 30% between 2019/20 and 2024/25 on trans-Tasman and Pacific Island routes (Qantas and Jetstar don’t disaggregate data sufficiently to generate a comparable estimate). Since the Pacific Islands represents a fraction of their capacity compared to trans-Tasman, this provides strong evidence of both higher load factors and higher prices. We’ll come back to this later, but evidence of higher loads and prices combined with declining transit traffic supports the argument that there’s been a supply crunch!

Methodological comment: why segregate 5th freedom flights?

There are several 5th freedom carriers providing trans-Tasman capacity, e.g. Emirates’s Dubai-Sydney-Christchurch and LATAM’s Santiago-Auckland-Sydney (although the latter is ending soon). These flights carry traffic on all three sectors, e.g. Dubai-Sydney, Dubai-Christchurch and Sydney-Christchurch. But there’s a quirk in the BITRE data: it measures passenger flows on both Dubai-Sydney and Sydney-Christchurch legs separately, but it doesn’t measure passengers on the Dubai-Christchurch leg. This means we don’t know how many seats are actually available for sale for the 5th freedom Sydney-Christchurch leg and BITRE data will underestimate the load factor on 5th freedom legs.

Who is responsible for the supply crunch?

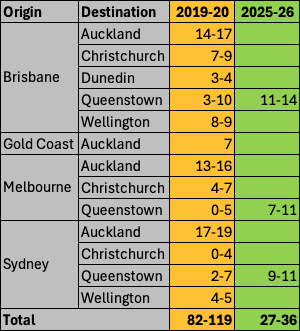

Qantas and Jetstar certainly aren’t responsible for the capacity crunch in the trans-Tasman market. They’ve added 472k additional seats in 2024/25 compared to 2018/19, an increase of 13% (6% and 32% individually). Meanwhile, Air NZ provided 211k (6%) fewer seats over the same time period, meaning a net increase at a market level, so who are we forgetting? We have short memories, but it’s easy to forget that prior to entering voluntary administration, Virgin Australia had a vast trans-Tasman network with 82 to 119 weekly flights each way connecting 13 city pairs.

They’ve since significantly downsized trans-Tasman flying, returning to only 3 routes to/from Queenstown, flying 27 to 36 weekly frequencies. Virgin’s capacity reduction has removed 1.3 million seats from the market (79% reduction). 5th freedom carriers have withdrawn 289k fewer seats from the market (28% reduction), resulting in a combined net reduction 1.4 million seats (14% reduction), reshaping the market!

As measured by passenger market share, Qantas and Jetstar now combine for 48% of the market, up from 37% in 2018/19. Despite declining capacity, Air NZ’s market share increased from 39% to 43% as their decline was slower than the aggregate market. Meanwhile, Virgin’s market share plummeted from 17% to 5%, reinforcing the impact of their capacity reductions.

5th freedom carriers also saw their market share decline from 7% to 5%, however this obscures the more consequentially decline from 17% in 2016/17. This larger decline is attributable to Emirates’s cancellation Brisbane-Auckland and Melbourne-Auckland in March 2018. A secondary consideration is whether we should consider Emirates’s capacity alongside Qantas and Jetstar, as they have a joint venture that extends to trans-Tasman routes. When combined, their market share has increased from 40% to 50% between 2018/19 and 2024/25, further highlighting their increasing market dominance in light of Virgin’s declining trans-Tasman capacity.

We’ve previously argued that the ACCC should’ve placed stronger conditions on the renewal of the Qantas-Emirates joint venture in 2023, with specific emphasis on trans-Tasman routes. Generally, joint venture approvals focus on ensuring capacity doesn’t decline on overlapping routes and/or networks as a result of the cooperation between the airlines, however the decline in combined market share from 43% to 40% between 2016/16 and 2018/19 (coinciding with the cancellation of Emirates’s Brisbane-Auckland and Melbourne-Auckland in March 2018) suggests that Qantas and Jetstar’s capacity increases during that time were insufficient to cover Emirates’s reductions.

Looking ahead

As noted at the outset, Qantas and Jetstar will add 800k more trans-Tasman seats in 2025/26. All else held constant, we expect their share of capacity will increase from 48% to 52%, or 52% to 56% including Emirates. In 2018/19, this was just 36% and 40%, reinforcing their increasing dominance. Furthermore, we should be careful not to ascribe blame as they aren’t responsible for Virgin and Air NZ’s challenges, and the counterfactual of them not adding this capacity would be an even larger supply crunch leading to even higher prices!

Things Can Only Get Better?!?!

Listening to the 1980s pop anthem “Things Can Only Get Better” gives us a sense of optimism about overcoming challenges. Unfortunately, listening to catchy songs doesn’t change the fact that things aren’t going to get better, or at least not anytime soon! Our thesis has three key points:

Air NZ aren’t in a position to counter Qantas and Jetstar’s capacity increases.

Sadly, 5th freedom carriers aren’t coming to save us.

Virgin don’t have any incentives to return trans-Tasman capacity in light of the nuances regarding their codeshare on Air NZ’s trans-Tasman routes.

Firstly, Air NZ’s fleet constraints aren’t going to be solved anytime soon. During their results presentation last month they confirmed the “Grounded aircraft position (is) expected to improve slowly, with majority returned to service by end of calendar 2027.” The operative word is “majority”, meaning that fleet constraints are likely to affect them through 2028. Even then, Air NZ are still short of their own historic benchmarks, nevermind filling the large gap that Virgin has left.

Secondly, 5th freedom carriers aren’t going to suddenly increase trans-Tasman capacity. Instead they’ll continue to reduce trans-Tasman flying, despite higher prices and yields. The most recent casualty is LATAM who will exit trans-Tasman 5th freedom routes in late 2025, favouring more non-stop capacity to Australia and NZ. This is a long term trend that we analysed in detailed a few years ago.

Finally, Virgin aren’t likely to return significant trans-Tasman capacity in the near future. Amidst aircraft delivery delays and historically poor performances on trans-Tasman routes, they’ve sought a codeshare on Air NZ instead (doesn’t extend to Air NZ’s domestic services, nor to Air NZ codesharing on Virgin’s trans-Tasman or domestic flights). This was approved by the ACCC in June 2024 and gave them access to to Auckland, Christchurch and Wellington, thereby helping them compete more effectively with Qantas’s network.

The approval included a nuanced technical point: Virgin only sought approval for codeshares on non-overlapping routes, thus excluding codeshares on Air NZ flights on routes to/from Queenstown. However, this is also forward looking meaning that if Virgin was to enter a new trans-Tasman route already served by Air NZ (e.g. Sydney-Auckland) they would cease codesharing on that overlapping route. On face value, this is very reasonable as codesharing on overlapping routes would limit competition on that route. However, it’s overly simplistic, ignoring the incentives for a new entrant on a high frequency route. Let’s consider the prospect of Virgin entering Sydney-Auckland:

At present, Qantas and Air NZ each have 4-5x/day flights (excluding QF3/4 that continues onwards to New York). Their schedules are distributed throughout the day, offering passengers a wide variety of times and connecting options, enabling them to generate higher yields than they would from similar capacity but concentrated capacity.

Without several daily frequencies Virgin would struggle to attract higher yielding passengers, resulting in lower yields than Qantas and Air NZ but without any cost advantage. To compete effectively with Qantas and Air NZ, Virgin would need to provide both morning and evening departures from Sydney, requiring at least 2x/day flights, and 3x/day if they aim to provide morning and evening departures from Auckland. That’s a lot of capacity for a new entrant to commit where they’d typically prefer to enter a new route with less capacity, limiting risk and building capacity over time as the route develops.

SYD-AKL

QF 141 7:05 12:12 D B738

NZ 110 7:45 13:00 D A32N

QF 143 8:55 14:05 D B738

NZ 102 9:55 15:10 D A32N

NZ 104 11:45 16:50 D B77W

QF 145 13:05 18:15 D B738

NZ 106 13:55 19:00 6x B789/B77W

QF 147 17:50 23:00 D B738

QF 149 19:15 00:25 D B738

NZ 112 19:15 00:30 D A32N

AKL-SYD

QF 140 6:00 7:35 D B738

NZ 101 7:00 8:45 D A32N

QF 142 7:35 9:10 D B738

NZ 103 9:00 10:30 D B77W

NZ 105 11:10 12:40 6x B789/B77W

QF 144 13:15 14:50 D B738

QF 146 16:05 17:40 D B738

NZ 111 16:20 18:05 D A32N

QF 148 19:15 20:50 D B738

NZ 109 20:00 21:45 D A32NBut it’s all or nothing for Virgin. If they were to enter the route 1x/day they would loose access to all of Air NZ’s 4-5x/day, while codesharing on overlapping routes would give them access to the alternative timings on Air NZ’s flights and help them maintain a competitive schedule with only 1x/day flights. Thus, the inability to codeshare on overlapping routes reduced Virgin’s incentive to enter any of these routes.

However, the ACCC approved Virgin’s application noting “concerns that the proposed conduct may reduce Virgin’s incentive to enter new trans-Tasman routes”. They indicated they were satisfied that it wouldn’t materially reduce Virgin’s incentive to enter new trans-Tasman routes after considering confidential information provided by Virgin on the revenue and margins they expected to earn from the codeshare compared to its current operations. That’s absurd!

Essentially, Virgin argued that their ability to add trans-Tasman capacity in the short run is constrained by overall capacity and that they’d earn higher revenue and margins elsewhere in their network. Airlines are far better placed than ourselves or regulators to decide where it’s best (most profitable) to allocate their scarce capacity. So we don’t contest this, however it’s not relevant to whether or not codesharing on overlapping routes would materially affect Virgin’s incentive to enter new trans-Tasman routes.

We might even go as far as using that position to argue lower revenue and margins on trans-Tasman routes compared to Virgin’s wider network means that codesharing on overlapping routes is neccessary for Virgin to even consider entering a new route like Sydney-Auckland. And it isn’t just Sydney-Auckland. Similar frequency dominated schedules are found on other routes including Melbourne-Auckland (Qantas 4x/day, Air NZ 4x/day), Brisbane-Auckland (Qantas 2x/day, Air NZ 4x/day), Sydney-Christchurch (Qantas 2x/day, Air NZ 2x/day), and Melbourne-Christchurch (Qantas 2x/day, Air NZ 2x/day).

We’ve going to leave you in limbo

This has been an unusually pessimistic analysis! Trans-Tasman routes have experienced a capacity crunch precipitated by Virgin’s significant withdrawal of capacity, leading to higher prices that have further surpassed demand. While systematic data on prices isn’t available, Air NZ’s yields have surged 30% since 2019/20, going a long way to explain Qantas and Jetstar’s significant capacity increases, while opportunistically exploiting Air NZ’s challenges to gain/increase their dominance. They’ll hold at least 56% of capacity in the coming year (compared to just 40% before the pandemic), leaving Air NZ with a lot of FOMO. If only they had the capacity to push into the market right now!!

We also shouldn’t be applauding Qantas and Jetstar. They’re not altruists, rather they’re following the money. But it begs the question why Qantas and Jetstar are choosing to allocate scarce capacity to trans-Tasman routes while Virgin are telling the ACCC that the market doesn’t look good?! We acknowledge that it’s easy to criticise from afar and this isn’t a shot at the ACCC. They don’t bare any responsibility for Virgin withdrawing so much capacity and the didn’t apply the non-overlapping condition. Virgin’s applied for it and they didn’t find any reason to exclude it. We must also consider the counterfactual that even if Virgin were allowed to codeshare on overlapping routes that they might not reenter these routes. Maybe we are just more worried about the our different reading of the strategy of the precedent it sets. The ACCC also couldn’t have contemplated Virgin’s strategy when they approved the renewal of the Qantas-Emirates joint venture. While we argued that the ACCC should have placed stronger conditions on the approval or limited its scope, it’s unlikely that this decision has affected Virgin’s strategy.

But where does this leave us? Are we just at the mercy of the market? Air NZ have strong incentives to push more capacity into trans-Tasman routes, however that won’t be anytime soon. In the interim, Qantas and Jetstar are filling the void but at the considerable long term cost of them increasing their dominant position that will give them greater pricing power going forward!

While somewhat outside the scope of this analysis, we do hope the ACCC will continue to track the trans-Tasman market, including following-up with Virgin to review how their estimates of revenue and margins play out. Would the ACCC reconsider the approval if market conditions are shown to be different? Even then, what can they do? As our counterfactual states, allowing codesharing on overlapping routes doesn’t mean they’ll actually do it. However, if market conditions are shown to be different would the ACCC go as far as revoking the approval to encourage Virgin to enter the market? Also, would they revisit the scope of Qantas and Emirates’s joint venture to encourage Emirates to reenter 5th freedom sectors, or reimpose it as a condition for future renewal?