Qantas Group to close Jetstar Asia

Qantas surprised us all today with the announcement that Jetstar Asia will be wound up in the coming months. We view this as a surprise, not because Jetstar Asia’s struggles aren’t well understood, rather because of Qantas’s steadfast support for Jetstar Asia in the aftermath of the COVID-19 pandemic.

Despite it’s inability to find sustainable profitability during two decades of operations, Jetstar Asia played an important strategic role in the Qantas Group providing connectivity and redundancy capacity to several important SE Asian destinations. The loss of connectivity presents several immediate challenges for Qantas and Jetstar, and likely wasn’t a decision taken without due consideration.

While Qantas’s statement pins the decision squarely on financial performance, blaming rising supplier costs, high airport fees, and intensified competition in the region, these are somewhat superficial as these are challenges that have been tolerated for much of the last two decades.

We propose an alternative hypothesis: firstly, that Jetstar Asia no longer provides the same strategic benefit it once did or was intended to provide; secondly, that the network effects are being achieved through other means; and thirdly, that the opportunity cost of capital allocation has increased given the increased profitability of Jetstar’s domestic operations in Australia and continued supply side capacity constraints. Let’s consider …

Background

Jetstar Asia began in 2004 with Qantas taking a 49% equity stake in the Singapore based carrier. Jetstar Asia’s strategy is best described as a hybrid between providing onward connecting capacity and competing for local O&D traffic with the later coinciding with the founding of Tigerair (later merged with Scoot) by Singapore Airlines in 2003.

Connecting capacity for Qantas (and later Jetstar) was focused on SE Asia and has since been extended to a range of other Qantas partners including Air France, Emirates, Finnair, KLM and SriLankan Airlines. This also supported Qantas’s strategic objectives to build Singapore into a regional connecting hub, not just for onward connections to Europe (including onward codeshare capacity on Air France, Finnair and KLM).

However, a strong connecting hub requires the support of a strong local O&D market to balance traffic flows and scheduling. However, Jetstar Asia was never quite able to achieve the scale required to achieve sustainable profitability. Tigerair, and its successor Scoot, has utilised their home field advantage to their benefit and won the war!

The connecting model has also been undermined in recent years by Jetstar Asia’s forced move to Changi T4, undermining the efficiency of connections to/from Qantas and other partners. However, it’s important to recognise that this is a more recent change and is not in itself to blame. It was more likely the nail in the coffin rather than the cause of death.

But the writing has been on the wall for a while. In the midst of the COVID-19 pandemic, Jetstar Asia’s fleet declined from 18 aircraft to single figures, and Qantas’s investment was fully impaired in the 2020 and 2021 financial years, taking a charge of A$ 146 million.

In the aftermath of the pandemic, Qantas continued to support Jetstar Asia, rebuilding the fleet to 13 aircraft and adding significant capacity to Singapore supporting Jetstar Asia’s connecting network. However, as Qantas’s announcement notes, Jetstar Asia continues to incur loses. This financial year, its expected to lose $35 million (underlying EBIT) which is a substantial amount for a small fleet of 13 aircraft.

Strategic significance?

Looking forward, Qantas’s consideration is strategic: it is worth continuing Jetstar Asia as a loss leader to support their network? There is no strategic benefit to fighting for the local O&D traffic as they’re unable to compete with Scoot who have achieved greater economies of scale.

Analysis shows that there will ultimately be minimal connectivity loss to Qantas as most destinations are served by existing direct Qantas and Jetstar services, or via codeshare capacity through existing partnerships. In several cases, Qantas and Jetstar have even significantly increased capacity or are planning to increase capacity to some destinations in the coming months. This latter point is important since it highlights a more deliberate shift by Qantas and Jetstar.

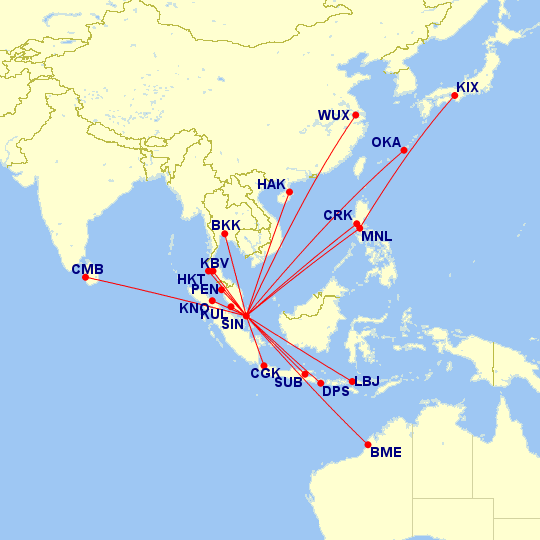

For example, Qantas and Jetstar’s capacity to Bangkok (BKK) and Phuket (HKT) has increased significantly, with Jetstar increasing frequencies on existing Melbourne and Sydney services, and starting new flights from Perth to Bangkok and Phuket and from Brisbane to Phuket. Over the last 3 months (Dec 2024 to Feb 2025), Jetstar provided 176,432 seats on 590 flights compared to just 85,760 seats on 256 flights during the same period in 2019/20. The only Jetstar Asia destination in Thailand that has been lost is Krabi (KBV), which is otherwise well connected via Bangkok through an existing codeshare partnership with Bangkok Airways.

Similarly, the loss of Jetstar Asia’s capacity to Manila (MNL) and Clarke (CRK) is well covered by Qantas’s Sydney-Manila and Brisbane-Manila flights, and will be supported by Jetstar’s forthcoming new Perth-Manila and Brisbane-Cebu flights.

Some destinations are simply more valuable or strategic than others. For example, the loss of connecting flights to Haikou (HAK) and Wuxi (WUX) in China is likely insignificant in the context of Qantas’s own retreat from Shanghai. These will be available through existing interline connections (e.g. on Cathay Pacific via Hong Kong).

Meanwhile, in Indonesia, Jakarta (CGK) and Bali (DPS) are well served by existing Qantas and Jetstar services, however flights to regional centres (e.g. KBO, SUB, LBJ) will be lost though. Colombo (CMB), Sri Lanka is served via existing codeshare partnership with SriLankan Airlines via Singapore and Cathay Pacific via Hong Kong.

In Japan, Naha (OKA) is served via existing Jetstar Japan flights from Tokyo Narita, while Osaka (KIX) served via existing direct Jetstar flights from Sydney and Brisbane, as well as Jetstar Japan from Tokyo Narita. In the case of Japan, Qantas and Jetstar have also significantly boosted capacity to Japan in recent years. Over the last 3 months, Qantas and Jetstar (combined) have provided 425,202 seats on 1,362 flights to/from Japan, compared to 396,984 seats on 1,244 flights. This will grow further in the coming months with the return of Qantas’s Sydney-Sapporo flights.

Mitigation

As is clear, the network impact is limited and, in many respects have been mitigated by Qantas and Jetstar’s recent capacity increases into countries like Japan, Thailand, and the Philippines. One might argue that these were strategic capacity investments to partly limit the impact of a potential closure of Jetstar Asia. Alternatively, Jetstar Asia’s demise might also be a partial casualty of these investments.

One significant loss though are connections to Malaysia as Kuala Lumpur (KUL) and Penang (PEN) will be lost. This has some strategic importance and Qantas doesn’t codeshare on Malaysian Airlines although it is a partner on Qantas Frequent Flyer.

We would expect Qantas and Jetstar to mitigate some of the network risks by expanding codeshare capacity on partner airlines and even engaging in new partnerships. Jetstar Asia flights to Australia (e.g. Singapore-Broome) are easily covered by Jetstar taking over those same services.

Looking ahead

Ultimately, the economics are winning Qantas over. Aircraft are scarce, but also expensive. Breaking even or just being profitable is insufficient to justify the investment in them. Our “Jerry Maguire” article from February comes to the fore once again! Furthermore, the strong margins that Jetstar are able to earn with these aircraft in Australia trump the best case scenario that Jetstar Asia could achieve, and with no other way to get hold of more aircraft in the short term it’s simply cheaper for Jetstar to shut down Jetstar Asia than source additional aircraft on the secondary market. It’s tough love!

As Qantas’s statement noted, Jetstar Asia’s fleet of 13x A320s will be transferred back to Jetstar’s domestic operations in Australia and New Zealand. Press reports note that several will be used to cover forthcoming lease returns of older A320s at Jetstar, while some will go onto Qantas’s FIFO operations, leaving only 3x for expansion. However, those lease returns were already partially covered by deliveries of new A320/A321s.

Something under appreciated in yesterday's Jetstar news was confirmation that their domestic capacity as measured by ASKs in the first quarter of FY26 would increase by 7%. This doesn’t sound like much in relative terms, but it’s massive in absolute terms. How big? It’s equivalent to 33 additional one-way MEL-SYD A320 sectors every day!

While this has been in Qantas’s forward guidance since the publication of their FY25 results it was always difficult to understand where this capacity was coming from. Yet now we know and also suggests that Qantas have been mulling this over for a while!

A strong argument can also be made that the investment in Jetstar Asia was never about its potential profitability but rather its strategic contribution to the group, particularly network connectivity via a SE Asian hub. However, this argument has been weakened over time by Qantas and Jetstar’s ability to overcome this through more direct flights into SE Asia. This has been supported by the A321LR, allowing lower cost capacity expansions into destinations like Bangkok, Cebu, Manila and Phuket, and doing so with less risk! Furthermore, it’s also allowed B787 capacity to Bali to be displaced, allowing those to be redeployed to Bangkok, Phuket, Osaka and Tokyo. They’re just less reliant on Singapore as a regional connecting hub as they once were.

Many questions remain regarding Qantas and Jetstar’s strategy in SE Asia. It raises the prospect of a new partnership in the region or increasing cooperation with an existing partner, although the immediate risks are small, allowing them to move forward without jumping at the first opportunity.

Personal note: We’d like to explain the recent slow pace of publications. Due to a recent bereavement, we’ve had to focus our priorities on family over the last few weeks. Our family needed a little more time and attention, and our priorities shifted. Things are settling down and we’ll get back to our usual flow in the coming weeks! Thanks for your understanding and continued support!