Why does Qantas acquire old aircraft for FIFO charters?

Over the last few months, Qantas have announced additions to their FIFO (fly-in fly-out) mining charter fleet in Western Australia. In June, they announced the acquisition of up to 14x “mid-life” E190s with deliveries beginning in 2026, while also in June they announced that several “mid-life” A320s would be transferred to the QantasLink FIFO fleet from Jetstar Asia later this year. While we don’t know the exact age of the E190s, Jetstar Asia’s 13x A320s range between 12 and 15 years, with an average age of 13 years.

These aren’t the only recent “mid-life” acquisitions for QantasLink’s FIFO fleet. Since 2024, they’ve acquired 9x A319s that range between 18 and 20 years old, while between 2018 and 2023 they took over 15x A320s that are now between 20 and 21 years old from Jetstar and JetstarAsia.

The additional E190s and A320s are joining the fleet to replace 14x Fokker F100s that are themselves between 31 and 35 years old. While the replacements seem young in comparison, they aren’t spring chickens!

Our friend and armchair CEO extraordinaire Caleb will likely have a very confident opinion how he would order new build aircraft from Airbus or Boeing for the FIFO fleet, but safe to say that he’d bankrupt the business instantly. Let’s explore why …

It’s the schedule, stupid

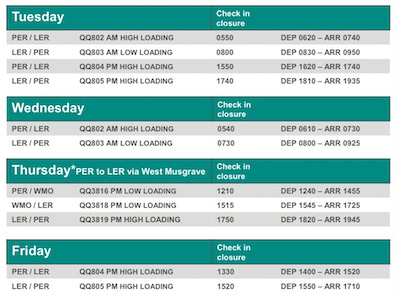

FIFO charter flights have an unusual schedule pattern. Flights are concentrated over a three or four day schedule, often between Tuesday and Friday, or sometimes between Monday and Thursday. For example, the FIFO charter schedule between Perth and Leinster, operated for BHP, has 2x daily rotations on Tuesdays, and 1x daily rotations on Wednesdays, Thursdays and Fridays. There are no flights on Mondays and weekends.

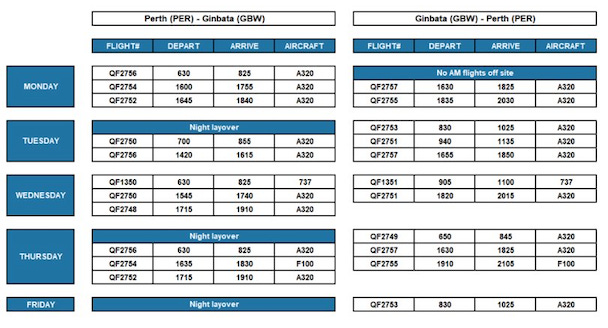

Another example shows the schedule between Perth and Ginbata, operated for Roy Hill. The schedule has 11x weekly outbound sectors between Monday and Thursday, with 1x return sector on a Friday due to a nightstop. However, there are no outbounds on Fridays, and no flights on weekends.

Almost all other FIFO charter schedules will have similar concentrated schedules. But why does this matter? Let’s have a look at actual aircraft utilisation!

What does ADS-B data tell us about aircraft utilisation?

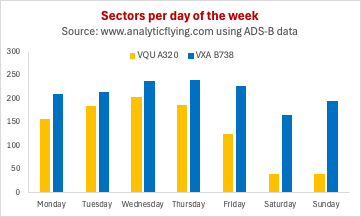

We picked two aircraft at random, one a Qantas mainline B737-800 (VH-VXA) and another a QantasLink FIFO charter A320 (VH-VQU). We used ADS-B data to track their utilisation over a full year (27 June 2024 to 26 June 2025).

Well, it wasn’t really random, we picked VXA because it was the first on the list, but then picked VQU since we wanted to match aircraft that had had similar base and heavy maintenance activities during the period under consideration. Comparing two aircraft with maintenance activities during the comparable period wouldn’t allow a consistent comparison.

This is where it gets interesting! Over the course of a full year, the Qantas mainline B737-800 flew 1489 revenue sectors compared to just 872 on the QantasLink FIFO A320. That’s a huge difference! The mainline aircraft flew 617 more sectors (71% more) during the year. Accounting for maintenance days, that’s an average of 4.4 sectors per day for the mainline B737 compared to 2.6 sectors per day for the FIFO A320. But are the FIFO sector longer, thus distorting the result? Actually, mainline sectors are longer, just! The mainline B737’s average sector was 1:52 compared to 1:42 on the FIFO A320.

We can also take these sectors and consider the distribution throughout the week. In absolute terms, the mainline aircraft flies more sectors on all days of the week, but the difference is far more pronounced on Mondays, Fridays and weekends, coinciding with the variations seen in the Perth-Leinster and Perth-Ginbata FIFO schedules.

Notably, the utilisation of the aircraft on Tuesdays and Wednesdays are only marginally different. Over the whole year, the FIFO A320 did 29 fewer Tuesday sectors and 34 fewer Wednesday sectors compared to the mainline 737. How we do we interpret this?

On 23 of the 52 Tuesdays in the year the FIFO A320 operated the same number of sectors as the mainline 737, while on 29 of the 52 Tuesdays in the year it operated one less sector in the day.

On 18 of the 52 Wednesdays in the year the FIFO A320 operated the same number of sectors as the mainline 737, while on 34 of the 52 Wednesdays in the year it operated one less sector in the day.

This metric is important since it highlights that on some days a FIFO aircraft can be just as busy as a mainline aircraft, however, this is limited to Tuesdays and Wednesdays. Mondays and Thursday are slightly less busy, but the difference starts to become noticeable. However, Fridays and weekends are very quiet.

Why buy a new aircraft for FIFO charters when it’s going to be idle for 41% of the time?

New aircraft are expensive! For example, recent data from industry databases shows that acquiring an older B737-800 or A320 (“mid-life” as Qantas would call it) will set you back US$ 12.5 or 10.9 million, respectively.

Meanwhile, the youngest examples would cost US$ 31.8 or 32.9 million, respectively. Meanwhile, a new B737-8 Max or A320neo will set you back US$ 56.1 or 54.8 million. The difference in price between older and newer aircraft are big!

Buying new aircraft will require an airline to utilise the aircraft to its full extent. Simply put: it can’t earn money when it’s not in the air! This should go without saying.

Airlines already operate on tight margins, and flying 41% less than a typical utilisation (as a FIFO charter aircraft does; 872 versus 1489 sectors) simply won’t generate a sufficient return for a new aircraft. But if the aircraft costs 61% or 67% less, as they do in the case of older aircraft, then all of a sudden it starts to make sense!

But why don’t they just utilise them elsewhere in the network on the days of low utilisation?

Well they certainly try to, but it’s not like mainline schedules are busy on weekendsQ As the figure above showed, mainline aircraft are busiest on the days that FIFO aircraft are also busiest, and quietest on the same days that FIFO aircraft are also quietest. That doesn’t leave much scope, however Qantas are already seeking opportunities to increase utilisation of the FIFO fleet.

For example, they recently announced 3x weekly Perth-Hobart and Perth-Newcastle flights utilising the A319s from September. In both cases, the flights operate on Sundays, Mondays and Fridays, coinciding with the low utilisation days. Existing FIFO aircraft utilisation on scheduled flights include Perth-Darwin (Mondays, Fridays, Saturdays, Sundays on A320s) and several others, however this belies the point as these services are already included in the ADS-B utilisation data. The data in the examples above didn’t filter out scheduled commercial flights and included both FIFO and scheduled commercial flights.

In flies Virgin’s E190-E2s

As astute reader may raise Virgin’s acquisition of 8x new E190-E2s, originally marketed as new aircraft for their FIFO charter operations. So how can Virgin order new aircraft for FIFO, but Qantas can’t?

The devil is in the detail! Virgin will operate the aircraft for FIFO charters, but not exclusively. In fact, their most recent press releases indicate that they plan to utilise the aircraft for both regular commercial operations in addition to FIFO charters. One might argue that the configuration of the aircraft with eight business class seats is indicative of the prioritisation of regular commercial operations rather than FIFO since none of Virgin and Qantas’s existing FIFO charter fleet have business class seats installed.

But how can Virgin utilise the aircraft across both operations efficiently but Qantas can’t? It’s really about scale: Qantas’s FIFO fleet and operation is much larger, presently 38 aircraft compared to Virgin’s fleet of 8 aircraft. It’s simply easier for Virgin to find enough flights for their 8x E190-E2s compared to Qantas’s 38.

There just aren’t enough flights ex-Perth for Qantas to find enough flying time on weekends, and to a lesser extent Mondays and Fridays to cover enough flying to justify younger aircraft. Virgin will find it equally difficult if their fleet were to grow beyond the 8x new aircraft.