Chart of the week #24: Australia-Europe market share

Last week, Virgin Australia Qatar Airways returned to the long-haul skies with their first flight to Doha under their new joint venture partnership and wet-lease arrangement with Qatar Airways. We posted a somewhat cynical comment on social media, highlighting how the nature of this arrangement is an externality of an obstinate government, a very aggressive Qatar Airways and a complex political economy.

The ongoing discussion reminded us of the narrative that was built when the government rejected Qatar’s requests to increase market access. At the time, the focus was squarely on Qantas given the media pile-on at the time. We engaged extensively in the debate, highlighting how Qantas didn’t stand to gain much from the government blocking Qatar, rather that their market share to/from Europe was small. We argued that the real winners were Emirates and Singapore Airlines. But this didn’t advance the pile-on, so was mostly ignored.

Who stands to benefit from Australia’s decision to block additional market access to Qatar Airways?

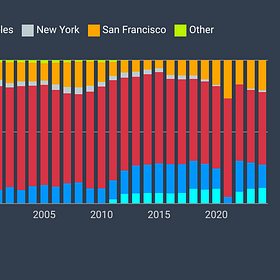

More recent data helps us look at this again. Ironically, this data comes from Virgin’s joint venture application to the ACCC! We were able to estimate the airline market share between Australia and Europe over a full year between June 2023 and May 2024. The data required some manipulation as the underlying data was presented separately for the UK and Europe, however we were able to weight the data utilising ABS data for the same period.

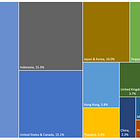

The data shows that Qantas only have a 9% market share to/from Europe. Emirates are the clear market leader with 30% and Qatar themselves with 21%, and Singapore in third with 11%. This reinforces our original point that Qantas didn’t stand to gain the most, and far from it!

A critique of this argument is that it says nothing about the relative importance to Qantas. However, we estimated that during the same period, European flying accounted for 16% of Qantas’s international capacity as measured by available seat kilometres (ASKs). Comparatively, the Americas accounts for 31% and Asia 38%, highlighting how Europe is somewhat a small part of Qantas’s international business. These estimates are drawn from our Capacity Tracker.

While 16% is significant, it’s certainly not dominant. Furthermore, Qantas international is only 42% of group capacity, meaning that Europe accounts only 7% of total capacity.

Complicating the narrative is that Australia has expanded access to several countries since. Arguably, this includes countries and carriers that are better positioned to challenge Qantas’s core market. These include significant capacity increases to Turkey, Hong Kong and Vietnam that added 84 weekly frequencies over time, far more than Qatar sought. And also open skies with Malaysia that removed frequency limits. Other liberalisations include Canada and Chile, however these are less consequential.

Yet, this has received almost no attention in the media. This post isn’t making excuses for the government or Qatar Airways. Both handled the situation poorly and childishly. While some commentators may view this as a victory for Qatar it comes at immense cost as this arrangement is increasing their cost base relative to competitors like Emirates and Singapore.

Rather, it’s a reminder that the popular policy narratives in aviation are simplistic. Reality is more complicated than many appreciate! Lost in this all is that Australia and Qatar still don’t have a Bilateral Air Services Agreement, and that Qantas’s lobbying was more complex than simply blocking additional capacity. Meanwhile, nobody seems to care that Emirates and Singapore stood to gain a lot more - they still don’t since it’s not convenient for the pile-on!

Just a reminder of our last “Chart of the week”, that looked at the evolution of point of departure of US-Australian flights over the last four decades, impact by changing technology and airline networks!

Chart of the week #23: How the point of departure of US-Australia flights has & hasn't changed over time

Earlier this month, United Airlines announced a new seasonal service between San Fransisco and Adelaide, starting in December 2025. The ensuing discussion on social media noted how the post-COVID era has led to a reconfiguration of flights between Australia and the United States.