Qantas's impressive Perth international expansion gains momentum!

Johannesburg and Auckland set to depart in December 2025

Qantas and Perth Airport spent several years playing a game of Russian Roulette over terminal facilities and airport charges. However, in May 2024 they agreed a new long term deal that includes the upgrading of Terminals 3 and 4 to enable further growth opportunities for Qantas’s international network before a new central terminal facility is completed in 2031.

Notably, that announcement of the agreement specifically pinpointed how the upgrades would enable new services to Auckland and Johannesburg from 2025. And Qantas have delivered on that, with 3x weekly flights to both Auckland and Johannesburg resuming from 7 December.

It’s never been a better time to review the new flights as well as recent development in Qantas’s impressive international growth at Perth.

Qantas, Jetstar and Perth

Qantas’s surge in long haul flying from Perth is impressive although somewhat incidental. For example, the non-stop London flight that began in 2018 was initially routed from Melbourne via Perth and ostensibly focused on Melbourne O&D traffic. However, the success of Perth O&D market and the recognition of Perth as a transit point to/from the rest of Australia ultimately led to the Melbourne leg being dropped in 2024.

In our analysis last year we showed that in the post-pandemic period, Perth O&D and transit passengers accounted for 82% of all passengers on the flight, with only 18% taking the same plane service to/from Melbourne. Whether it’s the O&D demand or the network effects that are driving growth, we’ve continued to see an impressive build-up with 3x weekly seasonal Rome in 2022 and 3x weekly year-round Paris in 2024.

In 2024, Qantas and Jetstar offered 473,500 international seats into Perth, an increase of 23% over 2019, and a 48% increase over the relative low in 2015. International seat capacity to/from Perth is complicated as many seats on one-stop flights are available for onward connections to Melbourne or Sydney, however this has steadily declined as the Perth O&D market has grown.

In 2024, 37% of Qantas’s seats were available as onward traffic to Melbourne or Sydney, down from 48% in 2023 (this is expected to decline further as the full-year impact of the cancellation of the Melbourne leg of QF9/10 is observed in the 2025 data). This compares to a negligible 1% or less before the inauguration of the non-stop London flight in 2018.

The balance between Qantas and Jetstar’s capacity has also evolved. Qantas’s capacity fell sharply from 2009 as flights to Indonesia were transferred to Jetstar, as was a significant portion of Qantas’s Singapore capacity. However, this isn’t the whole story as Qantas also cut services to Tokyo (2011), Hong Kong (2013) and Auckland (2018).

And it’s not just Qantas that are boosting international capacity from Perth. Jetstar have utilised the the A321LR to great affect, restarting Singapore, adding new flights to Bangkok and Phuket, and Manila later this year.

Auckland and Johannesburg

Auckland and Johannesburg have been on the drawing board for some time. For many years, Qantas served Johannesburg from Perth as a stop on their Sydney flights, however Sydney went non-stop in 2008 when Qantas began a bilateral codeshare partnership with South Africa Airways. That partnership was ultimately blocked by the ACCC in 2014.

Qantas has attempted to reenter Perth-Johannesburg several times. Their first attempt in 2018 was scuppered by the now well-discussed terminal challenges. Seasonal flights were restarted for the NW22/23 season but weren’t continued as Qantas were forced into using Terminal 1. Perth-Auckland was flown as recently as 2018.

It’s not accidental that Johannesburg and Perth have been added simultaneously as the flights are clearly timed to connect to each other. For example, Auckland-Johannesburg will have a neat 2 hour connection, likely using the same aircraft, while Johannesburg-Auckland has a 3.5 hour connection.

QF112 AKL PER 08:30 11:30 257

QF065 PER JNB 13:30 18:45 257

QF066 JNB PER 21:35 13:30+1 257

QF111 PER AKL 17:00 04:45+1 136The arrival into Auckland will enable onward domestic connections in the first round of departures from 6:15am or 6:30am (Qantas’s minimum connection time from international to domestic at Auckland is 90 minutes; 105 minutes on Jetstar). This timing is nearly identical to Qantas’s New York flight that arrives at 4:55am.

Meanwhile the 8:30am departure from Perth is tighter. Inbound domestic connections are limited by Qantas’s minimum connection time from domestic to international at Auckland of 75 minutes (i.e. arrivals up to 7:15am) or 120 minutes if inbound on Jetstar (i.e. 6:30am arrivals). However, there is a smattering of Air New Zealand domestic arrivals before 7:15am. You may recall that Qantas has a codeshare on NZ’s domestic flights!

The New Zealand-South Africa market is significantly smaller than the Australia-South Africa market, however it is still meaningful with 38,000 annual passengers in 2024 (still 16% down on its pre-pandemic peak in 2019). Comparatively, Australia-South Africa was 126,000 passengers in 2024.

The arrival time into Johannesburg makes most domestic connections impossible as Qantas applies a 2.5 hour minimum connecting time for its codeshare partner Airlink, comfortably missing their last domestic departures (e.g. to Cape Town and Durban)!

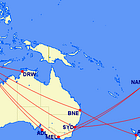

By the end of the year, Qantas and Jetstar will boast an impressive international network from Perth, including 10 destinations, compared to just 6 in 2006 and 3 in 2017!

Why is Qantas adding so much South Africa capacity?

We’ve covered the Australia-South Africa market extensively in previous analyses, initially provoked by the clever way in which Qantas planned to utilise the A380 on the route. As the operational schedule of the A380 evolved and as SAA unexpectedly returned to the route, we continued to follow the evolution with several follow-ups.

We pondered what might happen if Qantas resumed Perth-Johannesburg and concluded that they would likely manage capacity by reducing frequency of Johannesburg’s A380 flights. We’ll take a look at that, but let’s briefly review the market trends since our previous analyses.

Firstly, travel between Australia and South Africa has continued to recover with 125,610 arrivals in Australia from South Africa in 2024, an increase of 8% over 2023. This is still 17% below the 2019 level, however when considering the last 3 months through January 2025 (i.e. end of year holiday period) volumes are just 9% below baseline indicating an accelerating recovery.

These include arrivals on both non-stop flights and connecting traffic through 3rd countries, however they coincide with passenger numbers on direct flights highlighting how growing capacity on direct flights has supported the accelerating recovery. Passengers volumes and seat capacity on direct flights grew 31% and 34%, respectively, in 2024, aided by Qantas’s capacity increases and SAA’s return.

Qantas’s capacity increased substantially following the introduction of the A380 in October 2024, however comparing the three months from November through January to the same period in 2022/23 when Qantas temporarily operated Perth-Johannesburg shows similar aggregate seat capacity with the most recent period only 16% higher. This shows how the A380 helped Qantas backfill the lost Perth-Johannesburg capacity with the A380 on Sydney-Johannesburg.

However, SAA’s return on Johannesburg-Perth, followed by subsequent frequency increases has dramatically increased capacity. In that same three month period, capacity is now 55% higher! But how does the forward capacity look once Qantas add Perth-Johannesburg?

Qantas’s Perth flight certainly add a significant number of seats in December through March, however the forward NS26 schedule indicates that they’ll reduce Sydney-Johannesburg from 5x to 4x/week. Thus, while December through March shows significant year-over-year capacity increases (11%, 12%, 14%, 31%), capacity in April 2026 is estimated to be 5% lower than April 2025.

The variation in capacity is more volatile when SAA capacity is included, however it’s clear that Qantas expects to manage capacity between Australia and South Africa by modulating frequency on the A380 route.

More about the Perth strategy

Qantas are clearly targeting Auckland connections to/from the new Perth-Johannesburg flight, but this raises an interesting prospect: is Qantas targeting domestic connecting traffic?

Well yes! Qantas’s beef with Perth airport was about wanting to co-locate all their domestic and international flights in a single terminal. This makes connections more efficient and palatable for passengers compared to the trek across the airfield at Sydney. But just how fragmented is the South African market?

In a recent episode of the AviaDev Africa podcast, Behramjee Ghadially highlighted how Sydney accounted for only 36% of passengers between Australia and Johannesburg in 2024 (both directions), while Brisbane and Melbourne accounted for 18% and 15%, respectively. Perth accounted for 25%! That’s a sizeable proportion that would otherwise have to backtrack to Sydney, take SAA or via a 3rd country!

So it’s not just the 25% that Perth is targeting, but rather the 33% from Brisbane and Melbourne! Let’s face it, would you rather do a domestic to international transit (or vice versa) at Perth or Sydney?